Organization Trends

ESG Investing in “Democratic” Companies

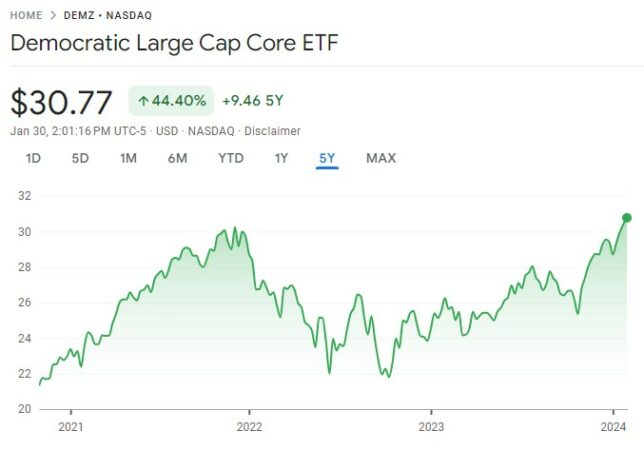

Democratic Large Cap Core ETF (DEMZ) market performance over the past five years. Credit: Google Finance.

Democratic Large Cap Core ETF (DEMZ) market performance over the past five years. Credit: Google Finance.

Environmental, social, and governance (ESG) has been rightly criticized for driving the politicization of American business, and it is hard to think of a more politicized method of evaluating corporations than by their political contributions. This is exactly what the Democratic Large-Cap Core Fund (DEMZ) does. It is worth examining both for the specific companies in its investment portfolio, as well as for how it illustrates an important distinction with respect to ESG investing, even among those who are skeptical of the practice.

“Democratic” Companies

The Democratic Large-Cap Core Fund (DEMZ) is an exchange-traded fund that invests only in companies that support the Democratic Party. A corporation is eligible for its portfolio if it is a member of the S&P 500 and if it provides more than 75 percent of its total political contributions (including those of top executives) to Democratic candidates and political action committees. According to the fund, as of December 2020 approximately 200 of the 500 companies from the index met these criteria—itself an interesting data point—and the fund’s portfolio was constructed from that group. DEMZ is managed by Reflection Asset Management, and it is fairly small, with net assets of approximately $30 million.

Billing itself as a way for “Democrats to invest” and to “invest in Democrats,” DEMZ promotes its holdings as being “fossil-fuel free.” It also claims that the companies in its portfolio support ESG priorities such as diversity, equity, and inclusion (DEI) programs; pay their employees a “living wage”; and pursue “thoughtful policies on climate change and environmental impact.” The fund singles out companies such as AT&T, ExxonMobil, and Lockheed Martin for supposedly being “Republican-supporting” and asserts that corporations run by executives who support Democratic politicians are inherently more profitable.

So what are these “Democratic” companies? DEMZ held 45 of them in its portfolio as of June 30, 2023, and many are household names:

- Adobe

- Advanced Micro Devices (AMD)

- Agilent Technologies

- Allegion

- Alphabet (Google)

- American Tower

- Amphenol

- Apple

- Avery Dennison

- Carrier Global

- CDW

- Colgate-Palmolive

- Costco

- Danaher

- Electronic Arts

- Everest Group

- Expeditors International

- FleetCor Technologies

- Gartner

- Gen Digital

- Hasbro

- Incyte

- International Business Machines (IBM)

- International Flavors & Fragrances

- IQVIA Holdings

- Kimberly-Clark

- KLA

- Lam Research

- M&T Bank

- Meta (Facebook)

- Moody’s

- NetApp

- NVIDIA

- Omnicom Group

- Paychex

- Progressive

- Prologis

- Ross Stores

- Salesforce

- Starbucks

- Stryker

- Walt Disney

- Warner Bros. Discovery

- Willis Towers Watson

- Xylem

It is a mostly unsurprising list. Technology companies are heavily represented, which dovetails with Big Tech’s famously left-leaning politics. Disney and Starbucks seem to exist perennially at the center of ESG-related news and controversy. Author Stephen Soukup devoted an entire chapter of his book The Dictatorship of Woke Capital: How Political Correctness Captured Big Business to Apple. Politico has called Salesforce CEO and philanthropist Marc Benioff “tech’s ‘woke’ CEO since before ‘woke’ was a thing.”

Indeed, several companies on the list are (or have been) associated with prominent liberal megadonors who give in ways that would not have factored in to the DEMZ fund analysis. In 2020, Meta’s Mark Zuckerberg sent $350 million to a nonprofit called the Center for Tech and Civic Life, which in turn distributed the funds to local election offices nationwide. Analysis demonstrated that the funding disproportionately went to Democratic-leaning counties in swing states. Zuckerberg also gives through Chan Zuckerberg Initiative, which has distributed nearly $5 billion since 2015.

The former CEO and chairman of Progressive—the late Peter B. Lewis—was one of the original funders (alongside George Soros) behind the Democracy Alliance, which subsequently expanded to become one of the largest and most influential left-wing funding networks in the country. Also present at the Democracy Alliance’s founding conference in 2005 was billionaire Stryker heiress Patricia Stryker, who alongside her brother Jon has frequently finished election cycles as one of the Democratic Party’s top political donors. Today, Patricia heads the Bohemian Foundation, and Jon Stryker heads the Arcus Foundation.

ESG Activism vs. Investing

Much of the controversy surrounding ESG stems from the way in which it shoehorns ideologically divisive sociopolitical issues—properly addressed through the democratic process—into a corporate sector that is ill-equipped to deal with them. In fact, the attempt to do so can be downright dangerous to democracy. It is currently impossible to separate ESG from politics, and by making political contributions its central investment determinant, DEMZ might be described as something akin to the “ultimate” ESG fund.

That said, even critics of ESG must concede that private investors should be free to deploy their money however they want, based on any criteria that they like—up to and including the partisan political contributions of the companies involved. There also exists a MAGA ETF, which does essentially the same thing as DEMZ except for Republicans, and the two funds are often compared with one another.

This gets at a helpful framework for thinking about ESG, at least as far as it concerns Americans’ interactions with public companies: the distinction between ESG activism and ESG investing. ESG activism refers to attempts to harness corporate power to advance controversial (and overwhelmingly left-of-center) sociopolitical objectives. It can take the form of public and private pressure campaigns, shareholder resolutions, support for new government regulations, or some other method. Those concerned with the politicization of American business would do well to focus their attention on these activists and their well-funded campaigns.

ESG investing refers to making investment decisions based on ESG factors. Generally, it becomes problematic only when asset managers are doing it on behalf of clients or beneficiaries who may not have specifically consented to it. For instance, the decision of three New York City pension funds to divest from oil and gas companies in 2021 is the subject of an ongoing lawsuit from plan beneficiaries. Eli Lehrer in the journal National Affairs recently cited DEMZ as an example of a fund in which the state of North Dakota would be legally (and rightly) barred from investing public assets, because it considers clear nonpecuniary factors. Any individual North Dakotan with a brokerage, of course, can buy as much DEMZ (or MAGA) as they wish.

So the bottom line is that while DEMZ might be a product of the ESG-driven rush to politicize American business—itself a significant societal problem—it does not automatically follow that the fund itself is contributing to that problem, provided that it is restricted to private self-directed investors who for whatever reason prefer their investments to be based upon political criteria.