Foundation Watch

Milton’s Bittersweet Legacy: A Lawsuit Round Robin

Milton’s Bittersweet Legacy (Full Series)

Too Much Money? | Unsavory Scandals

A Lawsuit Round Robin | Correcting the Course?

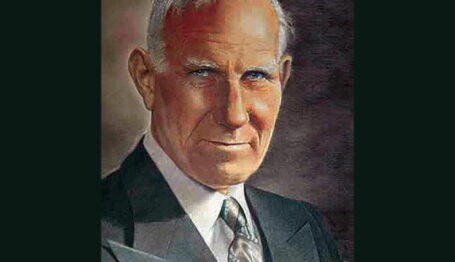

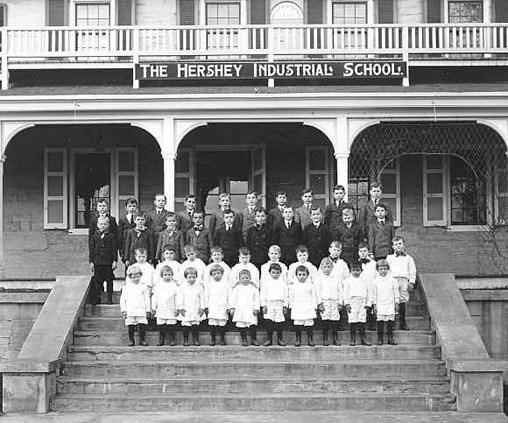

Summary: In this expansion of a March 2003 article, Martin Morse Wooster updates the complicated history of the Hershey Trust which runs and funds the Milton Hershey School. The 109-year-old organization, originally founded to provide aid and comfort to young orphans at the turn of the century, controls two profit-making enterprises, a unique situation in the foundation world. Not only does this tale offer a case study on how best to retain donor intent, it also portrays the sad decline of a great institution, presenting a record of recent scandal, financial impropriety, and sexual misconduct that has tarnished one of the most famous names in American philanthropy—and candy making.

Another AG Investigation

The continuing Hershey Trust case influenced the 2012 Pennsylvania attorney general’s contest, with Republican David Freed promising to appoint an independent prosecutor to handle the case because his father-in-law was LeRoy Zimmerman. Democrat Kathleen Kane responded, “I am an independent prosecutor, and Mr. Freed would have to hire one.” She won the election.

In May 2013, Kane announced that the state’s investigation of the Hershey Trust had concluded. The state found no improprieties in the trust’s purchase of the Wren Dale or Pumpkin World properties, but still imposed a requirement that it should notify the state of any property purchase that cost more than $250,000 or had a lease of more than three years. Compensation for members of the Hershey Trust board was reduced to $30,000 a year, with the chair of the trust being able to earn an extra $10,000. The ability of board members to serve on more than one board was sharply curtailed, and board members were required to fly coach while engaged on any Hershey business. Finally, the state said the trust should use its “best efforts” to find experts on at-risk students or residential education to serve on the board.

The Lancaster New Era, in an editorial, approved Attorney General Kane’s decision, but added that the decision didn’t explain why the Hershey Trust felt compelled to spend a lot of money on land that the Milton Hershey School might never need. “The Trust’s wheeling and dealing up to this point has emitted an odor,” the newspaper said, “and it doesn’t smell like chocolate.”

The settlement between the Pennsylvania Attorney General’s office and the Hershey Trust lasted only three years.

From Settlement to More Lawsuits

Ridiculously, the chief accomplishment of the Hershey Trust board from 2013 to 2015 was to spend vast amounts of the trust’s funds suing each other.

As Fernandez reported in May, one issue concerned Robert Cavanaugh, a Hershey Trust board member since 2003 who had also occupied one of the three Hershey Trust seats on the Hershey Company board, earning him an annual compensation of $332,633. Cavanaugh was also the beneficiary of a $3.8 million deferred compensation account and received over $80,000 a year in reimbursed expenses from the Hershey Trust for flying to board meetings in Pennsylvania from Los Angeles. These levels of compensation continued despite the aforementioned 2013 settlement, which limited Hershey Trust board compensation to $30,000 annually.

In April 2015, Cavanaugh sought a summer internship for his son, also named Robert, a Bucknell University junior. He asked Hershey Trust CEO Eric Henry for recommendations. Henry recommended two firms: Legato Capital Management, which managed $25 million of Hershey Trust investments, and JKMilne Asset Management, which oversaw $584 million of Hershey Trust assets. Henry emailed JKMilne Asset Management CEO John K. Milne, forwarding Robert Cavanaugh Jr.’s resume and making a reference to “our board chair’s son” wanting an internship.

Ten days after Robert Cavanaugh Sr. made his request, JKMilne Asset Management hired the younger Robert Cavanaugh for a 13-week internship, for which he was paid $13,000. (Most college internships are unpaid or only modestly compensated.)

After other board members complained about Cavanaugh Sr.’s nepotistic efforts to use his position with the Hershey Trust to get his son a summer job, they hired the law firm of Weil, Gotshal, and Manges to investigate the matter. The lawyers eventually released a 17-page report stating “we do not believe undue influence was applied” to get Robert Cavanaugh Jr. an internship, and that John Milne “followed his typical hiring process” in awarding the internship to him. Weil, Gotshal then billed the Hershey Trust $650,000 for their work!

Meanwhile, Robert Cavanaugh Sr., according to the New York Times’s David Segal, continued his machinations. Segal obtained a memo written by Hershey Trust chief compliance officer Marc Woolley in which Woolley summarized a conversation he had with Cavanaugh in September 2015. In the memo, the content of which Cavanaugh disputes, Woolley said that Cavanaugh claimed he wanted to “take out” board members who were conducting a “smear campaign” against him. Woolley also claimed that Cavanaugh was going to use a “suicide parachute,” although it’s not clear what Cavanaugh meant by this.

Cavanaugh’s more serious charge was that two Hershey Trust board members, Joan Steel and James Nevels, were profiting from insider trading of Hershey Company stock. The Hershey Trust hired several law firms, led by Zuckerman Spaeder, who found no wrongdoing and billed the trust $3 million. The Hershey Company retained two WilmerHale partners, former FBI director Robert Mueller III (the same individual now investigating President Donald Trump) and former Securities and Exchange Commission enforcement director William R. McLucas; both investigated and found nothing amiss.

Woolley was then fired by the Hershey Trust in July on the grounds that he was a “disgruntled employee” who had repeatedly badmouthed his employer. But he wasn’t the only member of the Hershey Trust legal staff pushed out the door. Bob Estey, the trust’s general counsel, resigned after he plead guilty to one count of wire fraud. Estey, a top adviser to Democratic Gov. Ed Rendell from 2003-07, had been enlisted in an FBI sting operation that took place shortly before being hired by the Hershey Trust in October 2011. The FBI operation had Estey posing as a lobbyist handing out corporate campaign contributions—an activity forbidden by Pennsylvania law. Prosecutors also charged Estey with taking $20,000 from the government for these “campaign contributions” and keeping $13,000 of that money. In 2017, Estey was sentenced to probation and was disbarred.

The Hershey Trust, again per Fernandez’s reportage, is also currently facing lawsuits concerning student conduct at the Milton Hershey School. These include:

- A federal investigation as to whether the school secretly worked to prevent physically disabled students (such as students in wheel chairs) from attending the school, thus violating the Americans With Disabilities Act.

- Two lawsuits from former students who say the Milton Hershey School does nothing to support students with depression. The parents of Abbie Bartels, a Hershey School student who was expelled after the 2012-13 school year and then committed suicide, are suing because they say the school did a poor job in handling their daughter’s depression. Adam Dobson, who was expelled in the summer of 2013 after announcing he was depressed and considering suicide, is suing the school. He also claimed that when he came out as a homosexual, his houseparents made him watch “a religious-based video…intended to ‘cure’ him of being gay.”

- A third case involved 11 former students at the Hershey School who sued for invasion of privacy over the activities of school employee Marcus Burns. Burns, fired in 2015 for secretly filming teenage boys in a shower, was sentenced in September 2015 by a Dauphin County, Pennsylvania, judge to a year in prison for invasion of privacy and for illegal possession of three guns on campus. The former students’ case was settled out of court for an undisclosed amount.

The 2016 AG Agreement

In July 2016, the Pennsylvania Attorney General’s Office issued a new agreement regarding the Hershey Trust and the Milton Hershey School. Among the new provisions of the agreement:

- Term limits of ten years for Hershey Trust board, with an additional year possible “to assure continuity of leadership” or to respond to other exceptional circumstances.

- Compensation for board members set at $110,000 per year with an additional $30,000 per year for the board’s chairman, and annual increases tied to Social Security cost of living increases. Hershey Trust board members could only serve on one other board, and those who served on the Hershey Company or Hershey Entertainment and Resorts board would have pay for their Hershey Trust service reduced to $80,000 per year.

- The board would expand to 13 members with five current members of the board ordered to retire, including Robert Cavanaugh and James R. Nevels, both of whom had to leave the board by December 2016.

- The attorney general’s office must receive 30 days’ notice of any new appointment to the Hershey Trust board.

The Hershey Trust board was asked to “use their best efforts” to find new board members “whose education, training, and experience reflect the full range of the board’s responsibilities, including, but not limited to: at risk/dependent children; residential childhood education; financial and business investment; and real estate management.” [1]

[1] Ironically, Attorney General Kane could not make the public announcement of the most recent settlement with the Hershey Trust: she had been disbarred. In August, she was convicted of nine counts of perjury, criminal conspiracy, and obstruction of justice over a 2014 incident. The Philadelphia Inquirer found she had shut down a sting operation which found Democratic elected officials from Philadelphia accepting gifts, money, and jewelry from undercover operatives. Kane retaliated by leaking grand jury testimony to the Philadelphia Daily News about the finances of former Philadelphia NAACP leader J. Whyatt Mondesire, who was never charged with a crime. Kane then lied about leaking the testimony. As of February 2018, Kane is appealing her conviction and has not spent any time in prison.

In the final installment of Milton’s Bittersweet Legacy, we look at possible ways to right the ship of the Hershey Trust.