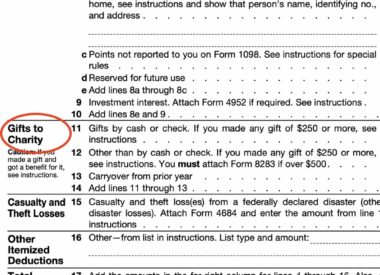

The Tenuous Place of Big Philanthropy in America’s Social Contract

Supposedly charitable philanthropy in America is tax-incentivized and has always occupied a nebulous position in the American polity—neither fully public nor pristinely private. Policy-oriented philanthropy, in particular, is large and getting larger,…