Foundation Watch

The United States of Goldman Sachs

The international investment bank continues to influence government no matter who’s in power

The relationship between Goldman Sachs and 2016 Democratic presidential nominee Hillary Clinton runs deeper than opulent speaking fees. Credit: Play It Forward Play It Forward. License: https://goo.gl/rB0Kb1.

The relationship between Goldman Sachs and 2016 Democratic presidential nominee Hillary Clinton runs deeper than opulent speaking fees. Credit: Play It Forward Play It Forward. License: https://goo.gl/rB0Kb1.

The elite investment bank Goldman Sachs has supplied Treasury secretaries to both Republican and Democratic administrations. A Goldman veteran serves as President Trump’s current Treasury Secretary and as his chief White House strategist. The firm leans left and cozies up to Big Government, remaining profitable while less well-connected firms perish.

“Government Sachs,” the Goldman Sachs tower in New Jersey. Credit: Andrew Fecheyr. License: https://goo.gl/uq5X2r.

Some things just don’t change in Washington. Republican and Democratic administrations are swept in and out of office. Whether after an election where the winner vows to “fundamentally transform America” in 2008, or eight years later when the winning candidate vows to “make America great again,” one thing is constant: the tentacles of Goldman Sachs continue to be embedded all over the federal government regardless of who is president. (Goldman Sachs was previously examined in the October 2008 and July 2009 issues of Foundation Watch.)

President Donald Trump hurled a few rhetorical grenades at the banking giant, as did Democratic presidential aspirant Bernie Sanders, the Independent senator from Vermont. Presidential candidates Hillary Clinton and Ted Cruz each had to explain their ties. Clinton pocketed $675,000 in speaking fees from Goldman Sachs, while Heidi Cruz, wife of the junior senator from Texas, previously worked for the firm.

Trump committed to assemble the best and the brightest from the business world—which we’ve seen in many of his cabinet picks. He’s seeking institutional knowledge from people who know about business and the government to get the economy moving again.

Still, it’s difficult to forget the Trump campaign commercial that showed the Goldman Sachs CEO’s face as the narrator talked about “a global power structure that is responsible for the economic decisions that have robbed our working class, stripped our country of its wealth and put that money into the pockets of a handful of large corporations and political entities.” During the Republican primary campaign Trump said: “I know the guys at Goldman Sachs. They have total, total control” he said, referring to Cruz, “just like they have total control over Hillary Clinton” (New York Times, Dec. 9, 2016).

“Government Sachs”

After Trump came into office, he filled the administration with Goldman alumni, notably Treasury Secretary Steven Mnuchin and his deputy Jim Donovan, and National Economic Council Director Gary Cohn. Even top White House strategist Stephen K. Bannon was at one time an investment banker with Goldman, though in the years since he has become an outspoken populist.

And guess who’s angry?

It’s very telling that today’s same left-wing “Resistance” rallies against Goldman weren’t happening when former Goldmanites packed the ranks of the Obama administration. And there were many. For example, before being appointed to the Supreme Court, Elena Kagan briefly served as Solicitor General in the Obama administration. Before that she was a member of the Research Advisory Council of the Goldman Sachs Global Markets Institute. Although Steve Friedman originally chaired the President’s Intelligence Advisory Board under President George W. Bush, his term extended into the Obama administration.

Other notable Goldman alumni serving in the Obama administration include Rahm Emanuel, the White House Chief of Staff who is now mayor of Chicago; Robert Hormats, who served as Under Secretary of State for Economic Growth, Energy, and the Environment; and Gary Gensler, who served as chairman of the Commodity Futures Trading Commission.

This is not an exhaustive list.

Conservative journalists such as Tim Carney and Michelle Malkin often used the phrase “Government Sachs” to describe the firm because of its deep ties to the Obama administration. Now things have come full circle. In February, left-wing activists rallied outside the Goldman Sachs headquarters in lower Manhattan, protesting “Government Sachs.”

Always eager to jump on the nearest Occupy Wall Street-style bandwagon, the far-left Massachusetts Sen. Elizabeth Warren (D), along with Wisconsin Sen. Tammy Baldwin (D), wrote Goldman CEO Lloyd Blankfein a letter expressing how deeply troubled they were about the “influence” Goldman has on the Trump administration.

The far-left Massachusetts Sen. Elizabeth Warren—always eager to jump on the nearest Occupy Wall Street-style bandwagon. Credit: Tim Pierce. License: https://goo.gl/ssCpnG.

“Dismantling Dodd-Frank would be a financial boon for large banks, including Goldman Sachs,” the lawmakers wrote. They also noted Goldman’s market value soared after Trump signed an executive order to begin dismantling Dodd-Frank, the heavy-handed financial regulation law that President Obama signed in 2010 (CNN, March 17, 2017).

But these senators weren’t as concerned about Goldman’s influence during the Obama years.

Whichever party is in power, Blankfein dismisses such concerns about the firm’s disproportional influence. He isn’t running away from the “Government Sachs” label. He welcomes it. He said in March of this year he wants more executives from the firm serving in government roles.

“We will continue to encourage our people to contribute to government service if they are fortunate enough to be asked,” Blankfein wrote in an annual shareholder letter. He went on to address the concerns about any conflicts. “Those in government bend over backward to avoid any perception of favoritism” (CNN, March 17, 2017).

Cohn was president of Goldman before moving to the Trump administration, a typical spring board to high federal office. “Gary was not the first person from Goldman Sachs to join the government, and we hope and expect that he will not be the last,” Blankfein said. “Five of my most recent predecessors went into government service, and that has not been by happenstance.”

Recently, a rift was reported between Bannon, the economic nationalist, and Cohn, the globalist and registered Democrat who supported President Obama. The two are reportedly clashing over tax and trade policy. The White House denied any rift (Fox Business, March 15, 2017).

Donovan was Group Managing Director at Goldman before becoming second-in-command at Treasury. Trump selected Jay Clayton, an attorney who has defended Goldman, to chair the Securities and Exchange Commission. At the time of this writing, the nomination was pending in the Senate. Also, former Goldman Sachs partner Dina Powell was appointed as one of the two Deputy National Security Advisors.

Trump should be wary that former Goldman executives don’t interfere with a reform agenda. Reform isn’t a priority for the company that has typically backed numerous causes on the left. Sure, Goldman knows how to make money, but it doesn’t necessarily believe in free enterprise and has been the king of crony capitalism in many ways.

So far, there is no evidence that the firm is pushing Trump to the left. Yet Blankfein opposed Trump’s so-called extreme vetting policy on seven Middle Eastern countries that are terrorist hotbeds, asserting, “This is not a policy we support … I recognize that there is potential for disruption, and especially to some of our people and their families.”

On another front, Goldman executives were pushing for Trump to hold off on repealing and replacing Obamacare, because the company felt it would distract the new administration from working with the Republican Congress on tax reform.

Goldman economists wrote in February: “This process is likely to take longer than expected, which is likely to delay the upcoming debate over tax reform. The difficulty the Republican majority is having addressing a key political priority suggests that lawmakers might ultimately need to scale back their ambitions in other areas as well, such as tax reform.”

Goldman’s Nonprofit Arms

Since it began facing increased scrutiny in the years following the financial crisis, the Goldman Sachs Foundation has not only greatly increased its charitable giving, but the company as a whole has also moved into hyper-drive to pour money into politically correct progressive nonprofits. It backed an Obama identity-politics agenda and same-sex marriage. The company has a long history of going all-in on climate change activism, seeking to profit from government policies that harm the larger economy.

But Goldman and its employees don’t just fund environmentalists, according to IRS filings. Planned Parenthood has received $2,967,990 since 2003 from the Goldman Sachs Philanthropy Fund and the Goldman Sachs Foundation combined. The Goldman Sachs Philanthropy Fund has given to Catholic Relief Services ($4,160,700 since 2004), U.S. Conference of Catholic Bishops ($1,795,934 since 2009), and the Natural Resources Defense Council ($266,000 since 2007). The Fund has also given generously to donor-advised funds such as the Vanguard Charitable Endowment Program ($73,962,248 since 2007) and the National Philanthropic Trust ($18,419,202 since 2008).

Advocating such left-wing causes allows class-warfare-obsessed Democrats to have a clear conscience in backing a big corporation. Meanwhile, far too many establishment Republicans are unwilling to distinguish being pro-free market from being pro-business—thus, favoritism might seem acceptable.

What Bill Frezza, a fellow with the Competitive Enterprise Institute, wrote for Real Clear Markets in 2012 is still true today:

“No, Goldman Sachs is not a law breaker. With all the former executives and cronies it has parachuted into the halls of government and all the money it showers on politicians running for office, it is actually a law maker. And that is the problem. Thanks to this last banking crisis, the lines between the Treasury, the Federal Reserve, the Executive branch, and Goldman Sachs have all but disappeared. Using the entirely legal means of calling in chits from both political parties in its hour of need, Goldman Sachs looted the Treasury to save it from a liquidity crisis, cover its speculative investment errors, and make good on winning gambling bets that would have been uncollectable had Uncle Sam not stepped in to bail out counterparties like AIG.”

Goldman’s Climate Agenda

In a letter to shareholders that accompanied the 2015 annual report, Blankfein and Cohn, stated that the company was ahead of most other firms in tackling climate change when it established its Environmental Policy Framework in 2005.

“Specifically, to facilitate the transition to a low-carbon economy, last year we updated our Environmental Policy Framework to include an increased target of $150 billion in clean energy financings and investments by 2025, up from an earlier target of $40 billion,” the letter to investors said. “Finally, we continue to be mindful of our own operational impact on the environment, pledging to be carbon neutral from 2015 onwards and to target 100 percent renewable power to meet our global electricity needs by 2020.”

The company first announced in 2009 it was working with renewable energy leaders, purchasing carbon offsets and purchasing more green power for its various facilities to meet the carbon neutral goal by 2020. The announcement of spending $150 billion on green energy also made big news, particularly at a time when many green businesses seem to be failing.

“We believe that climate change is one of the most significant environmental challenges of the 21st century and is linked to other important issues, including economic growth and development, poverty alleviation, access to clean water, food security and adequate energy supplies,” Blankfein says on the Goldman Sachs website. “We are committed to catalyzing innovative financial solutions and market opportunities to help address climate change.”

With the new financial commitment, the firm wrote in its new policy framework, “Goldman Sachs acknowledges the scientific consensus, led by the Intergovernmental Panel on Climate Change, that climate change is a reality and that human activities are responsible for increasing concentrations of greenhouse gases in the earth’s atmosphere” (Wall Street Journal, Nov. 2, 2015).

Green energy companies affiliated with Goldman haven’t done so well. The Wall Street Journal reported that Goldman client Solar City, as well as Sun Edison, had slow-downs in solar and wind projects. Another client, Chorus Clean Energy had a disappointing initial public offering. And since 2012, the Nex Clean Energy Index underperformed most of the stock market benchmarks, such as Standard & Poor’s. In 2006, Goldman Sachs purchased 10 percent interest in the Chicago Climate Exchange, which specializes in selling carbon offsets. Thus, the firm has a deep economic interest in seeing the climate change narrative pushed politically. The problem is that so many of these green companies can’t survive without federal loans and grants. (Carbon offsets and other regulatory schemes aimed at carbon emissions are examined in the August 2007 and August 2008 issues of Foundation Watch; the December 2011 and August 2013 issues of Green Watch; the January 2009 issue of Organization Trends; and the February 2017 issue of Capital Research magazine.)

The company’s stance on climate change didn’t go unnoticed by the Obama White House, which praised Goldman in an October 2015 press release regarding the American Business Act on Climate Pledge. According to the White House press release: “Goldman Sachs is targeting $500 million of financing and co-investments in companies that develop and deploy advanced clean energy technologies, including for smart grid infrastructure and advanced battery solutions. Investments in advanced technologies are important in order to modernize the grid and facilitate reliable and flexible expansion of clean energy, and are part of Goldman Sachs’ longstanding commitment to deploying capital to scale up clean technology and renewable energy.”

In 2006, Goldman established the Center for Environmental Markets, which works with green nonprofits because, “We recognize that many critical environmental issues cannot be solved through voluntary action alone and that establishing partnerships and ecosystems that bring together key public and private sector stakeholders is important.”

Nothing makes the Left happier than hearing phrases such as, “cannot be solved through voluntary action.” The GS Center for Environmental Markets announced it would spend another $10 million in grants on multiple environmental groups and is already parting with the Climate Group, the Nature Conservancy, the Natural Resources Defense Council, the World Resources Institute and the Banking Environment Initiative among others.

Retired Goldman Sachs executive Larry Linden has been one of the top advocates for a carbon tax. He established the Linden Trust for Conservation and is funding a $3 million project by Resources for the Future to analyze the fiscal and environmental impact of a carbon tax (Inside Philanthropy, Nov. 10, 2015).

In the blood and gore connection, former Goldman Sachs CEO David Blood teamed with former Vice President Al Gore to establish General Investment Management in 2006. The board of the company was mostly composed of former Goldman executives.

The relationship between Goldman Sachs and 2016 Democratic presidential nominee Hillary Clinton runs deeper than opulent speaking fees. Credit: Play It Forward Play It Forward. License: https://goo.gl/rB0Kb1.

Clinton Connection Beyond the Speeches

The relationship between Goldman Sachs and 2016 Democratic presidential nominee Hillary Clinton runs deeper than opulent speaking fees. The firm contributed between $1 million and $5 million to the Clinton Foundation, according to the foundation’s website. Clinton Foundation CEO Robert S. Harrison is a veteran of Goldman Sachs, where he was a partner in the firm’s investment banking division and global co-head of its Communications, Media, and Entertainment group. Meanwhile, Goldman has consistently been a funder and participant in the Clinton Global Initiative. All told, Goldman Sachs has been the second largest contributor throughout Hillary Clinton’s political career, with employees spending $760,740 on her two Senate and two presidential campaigns (McClatchy, Jan. 26, 2016).

When running scared in last year’s Democratic presidential primary against Sanders, Clinton consistently bashed banks on the campaign trail. Yet when CNN’s Anderson Cooper asked if taking such hefty speaking fees was “a bad error in judgment?” Clinton responded, “I made speeches to lots of groups. I told them what I thought. I answered questions.”

Cooper followed up, “But did you have to be paid $675,000?” Clinton blithely replied, “Well, I don’t know. That’s what they offered.”

That would be a perfectly respectable answer if Clinton seemed inclined to believe in a free market system. But given the certainty that Clinton would be a presidential candidate, it seems more likely that a firm constantly looking to maintain a symbiotic relationship with the federal government was investing in its future. It also seems probable that, like most of the establishment, executives pegged Clinton as a safe bet to win.

Several of the attendees at Hillary’s speeches at Goldman reportedly said she went on about how stupid it was to bash big banks. As Katherine Timpf wrote, “What people are willing to give you in exchange for your time is a direct measure of how much they appreciate you. No doubt, $675,000 is a lot of money … so, if that’s what they offered her, then that can mean only one thing: They like her a lot. After all, would any firm pay someone $675,000 to come hang out and tell them that they’re garbage? Based on simple logic, I’m thinking probably not” (National Review, Feb. 4, 2016).

On another more indirect front, the watchdog group Foundation for Accountability & Civic Trust (FACT) filed a complaint with the U.S. Office of Government Ethics, alleging that “Clinton gave a private company special access to the State Department based upon the company’s relationships with Secretary Clinton’s family members and donors to the Clinton Foundation.”

Harry Siklas, an investor in Neptune Minerals Inc., was also an employee of Goldman Sachs, of which Neptune is a client. He asked to meet then-Secretary of State Clinton and other State Department officials at the time Clinton was advocating for the Law of the Sea Treaty. The treaty purportedly would assist U.S. mining companies searching for minerals in international waters, but the Senate blocked it. FACT says Siklas’ ties to Goldman might have been relevant, given Goldman’s support for Clinton’s 2008 presidential campaign and donations to the Clinton Foundation (Investor’s Business Daily, Dec. 15, 2015).

Goldman and the GOP

Goldman Sachs has ties to Republicans as well—beyond the Trump administration. Nearly the entire Republican presidential field in 2016 had some financial ties to Goldman Sachs through investments, according to a Reuters analysis of financial disclosure forms (Reuters, Jan. 21, 2016).

The New York Times went after Cruz for getting a loan for almost $500,000 from Goldman to help finance his 2012 Senate campaign. The Times primarily faulted the senator for not initially reporting the loan to the Federal Elections Commission. However, Cruz did report the loan on his Senate financial disclosure form, and he said leaving it out of the FEC form was an oversight. A Cruz campaign spokeswoman said the loan has “been reported in one way or another on his many public financial disclosures and the Senate campaign’s FEC filings” (New York Times, Jan. 13, 2016).

Early in last year’s primaries, employees of Goldman Sachs had contributed a total of $43,575 to Cruz’s presidential campaign, significantly less than Clinton received from those associated with the company. (McClatchy, Jan. 26, 2016). Cruz said he would “absolutely not” support another corporate bailout, and directly criticized Goldman.

“Goldman is one of the biggest banks on Wall Street, and my criticism with Washington is they engage in crony capitalism,” Cruz said. “They give favors to Wall Street and big business and that’s why I’ve been an outspoken opponent of crony capitalism, taking on leaders in both parties. I think big business, if they’re building a better mousetrap, great, but it shouldn’t be government favoring, and let me give you an example: Dodd-Frank. Sold to the American people as stopping ‘too-big-to-fail.’ What happened? The big banks have gotten bigger. Goldman has gotten bigger” (Bloomberg News, March 24, 2015).

Trump was a shareholder in Goldman Sachs. Trump’s various businesses are reportedly indebted to several Wall Street banks in the hundreds of millions (Red State, Jan. 16, 2016).

Wading Into the Culture Wars

It came as a bit of a surprise in 2012 when Blankfein leapt into the cultural war, doing a commercial for the Human Rights Campaign, an LGBT advocacy organization, to support same-sex marriage. He became the group’s first national corporate spokesman.

“I’m Lloyd Blankfein, chairman and CEO of Goldman Sachs, and I support marriage equality,” Blankfein said in a TV spot recorded at the bank’s Manhattan headquarters. “America’s corporations learned long ago that equality is just good business and is the right thing to do.”

Blankfein’s support wasn’t a secret, as he publicly urged the New York State legislature to approve same-sex marriage long before agreeing to do the advertisement for the gay group. The New York Human Rights Campaign gave its Corporate Equality Award to Goldman. “Lloyd Blankfein is not someone average Americans would think is going to support marriage equality,” Human Rights Campaign executive Fred Sainz said. “The green visor crowd is not typically associated with socially progressive policies, and this is further proof that a diversity of Americans are coming to the same conclusion” (New York Times, Feb. 5, 2012).

Joining Obama With the Gender Card

Goldman boasts on its website that since 2008 it “has committed in excess of $1.6 billion to philanthropic initiatives.”

“Goldman Sachs works with over 100 academic and nonprofit partners and is routinely among the leaders identified in the Chronicle of Philanthropy,” the site states. “In 2011, one of Goldman Sachs’ philanthropic programs, 10,000 Women, received the Committee Encouraging Corporate Philanthropy’s coveted Chairman’s Award.” Its 10,000 Women program may well be a worthwhile cause. Under it, Goldman Sachs is trying to spur more women to become entrepreneurs in the United States and around the world. The point at which it might raise a red flag is that it directly coincided with Obama administration initiatives.

Goldman’s 10,000 Women initiative targets 56 countries across the Middle East, Africa, and South America. It helps women with business education and access to capital. “In 2014, The Goldman Sachs Foundation and International Finance Corporation, a member of the World Bank Group, launched the first-ever global finance facility dedicated exclusively to women-owned small- and medium-sized enterprises,” the Blankfein and Cohn letter to shareholders said. “To date, the facility has made more than $400 million in commitments to banks in 14 countries, enabling women from Kenya to China to Laos to access capital and grow their businesses. In 2015, President Obama announced a $100 million commitment by the Overseas Private Investment Corporation, demonstrating how the facility is catalyzing new investments from both the public and private sectors in women-owned enterprises globally.”

As part of the effort, Goldman created the first $600 million financing facility to help 100,000 women around the world start businesses. “Two years later, this public-private partnership, spurred by private sector innovation, has catalyzed new investments from both the public and private sectors and reached more than 25,000 women in 14 countries,” according to the Goldman Sachs website.

In July, President Barack Obama praised Goldman for the initiative when speaking in Kenya. “And as part of that $1 billion that I mentioned earlier, the United States Overseas Private Investment Corporation is contributing $100 million to support Goldman Sachs’ 10,000 Women initiative, making more capital available to women-owned enterprises around the world,” Obama said.

The White House sponsored a summit called, “The United States of Women,” on May 23 last year, “with additional cooperation from Goldman Sachs 10,000 Women, the Tory Burch Foundation and the Ford Foundation.”

The Goldman letter to shareholders, which accompanied the 2015 annual report, went on to talk about the need for “companies for multicultural women.” “Attracting and retaining the highest-caliber talent also means that we must invest in our people early on in their careers—

the best of whom will become the next generation of leadership at the firm,” the letter said. “Building off the learnings of our biennial People Survey, last year we unveiled a set of new initiatives designed to support junior employees, giving them more flexibility and greater exposure to our client franchise. In 2015, we also selected our newest class of managing directors. In addition to hailing from more than 40 countries, 40 percent of the class of 2015 started at the firm as analysts, a testament to our emphasis on talent development and retention for the long haul.”

Coincidental Timing

This and other charitable giving seemed to be timed with buying redemption. As the New York Times reported, “Then, in late 2009, the company faced mounting criticism about the billions of dollars it was paying out in bonuses in the wake of the financial crisis. The firm needed some good public relations. And fast. Goldman committed $500 million over five years to another program, 10,000 Small Businesses, which helps businesses in the United States and Britain.”

In 2012, Goldman gave $241.3 million to charity, up from $47 million in 2006. A Goldman employee not authorized to speak on the record told the Times anonymously that the charitable giving is “run as if it’s a Broadway show.” But even the Goldman official authorized to speak to the Times seemed to indicate public relations motives were behind the giving. “Engaging wasn’t just the right thing, it was necessary, especially in the wake of the financial crisis when people said we weren’t doing enough,” said John F.W. Rogers, Goldman Sachs’ chief of staff for philanthropic efforts (New York Times, Oct. 26, 2013).

The Poster Child of Crony Capitalism

Goldman Sachs has been the poster child of crony capitalism over multiple administrations, as author and journalist Peter Schweizer explained in an interview with the Acton Institute. “If you look back at the history of the last 20 years, you come to the realization that firms like Goldman Sachs, for example, have been bailed out five times over the last 20 years,” Schweizer said. They were bailed out first in 1993 when they bought a bunch of Mexican government bonds that went bust.”

“Large firms, like the Wall Street firms for example, are generally in favor of Dodd-Frank, which creates this highly complex, and expensive regulatory maze that most people can’t even understand,” he added. “If you’re Goldman Sachs with your size and scope and assets and the number of attorneys that work for you, and you’re competing against a firm that is one third your size, the firm that’s one third your size is going to have a much more difficult time complying with those regulations. So large firms like complexity and government likes to deal with a smaller number of large firms rather than a large number of small firms.”

One reason for the coziness could be that Goldman Sachs has been a springboard to high-ranking government positions, and it’s been that way since the Clinton Administration. (Before the aforementioned Trump officials, Robert Rubin and Henry Paulson were Goldman executives who became Secretary of Treasury for Bill Clinton and George W. Bush, respectively.)

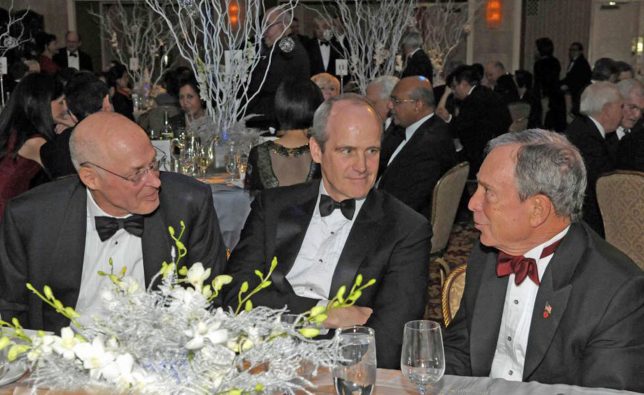

From left, Henry Paulson, Jr., former United States Treasury Secretary and CEO of Goldman Sachs, Asia Society Trustee J. Michael Evans, and New York City Mayor Michael Bloomberg. Credit: Elsa Ruiz. License: https://goo.gl/kBKN2B.

Though Obama frequently used populist rhetoric to rip Wall Street firms, Goldman continued to hold an exalted place in his administration. It typically came with a wink and a nod, though, as he would publicly bash big corporations. In 2010, after the SEC began its litigation against Goldman, the Democratic National Committee bought Google ads that directed someone who typed the search terms “Goldman Sachs SEC” to go to the website of Obama’s community-organizing nonprofit, Organizing for Action. This attempt to gather Goldman’s critics into the Obama activist brigade occurred despite the fact that Goldman employees contributed $994,795 to Obama’s 2008 election (National Review, April 21, 2010. Organizing for Action, previously named Organizing for America, was profiled in the May 2010 issue of Organization Trends.)

Obama named Goldman Sachs partner Gary Gensler to chair the U.S. Commodity Futures Trading Commission. Former Goldman Sachs lobbyist Mark Patterson went on to work in the Obama Treasury Department to oversee the Troubled Assets Relief Program (TARP) bailout. Goldman Sachs indirectly got $10 billion from TARP. Obama also named former Goldman Sachs attorney Tom Donilon as his National Security Advisor.

It’s difficult to imagine this powerful entity relinquishing its vise grip over the federal government, particularly since it is so thoroughly entrenched in both parties. That seems to be true, even after the earthquake election last November.

Crony capitalism is a larger problem than just this one firm. But Goldman Sachs holds a special place among firms that influence government, and glomming on to whatever the progressive, “social justice” cause du jour may be has become a convenient way for the company to maintain that grip. As CEI’s Bill Frezza warns, “At what point will players like Goldman Sachs have handed so much ammunition to left-wing radicals who cannot tell the difference between crony capitalism and the real thing that they succeed in blowing up Western civilization? If real market capitalists don’t step up and speak out against purveyors of cronyism and the politicians from both parties that enable them, it is just a matter of time before we all go down together.”

Fred Lucas is the White House correspondent for The Daily Signal.