Special Report

Government Funded Nonprofits Fail to Help Seniors (Part 2)

Capital Research Center gratefully acknowledges the assistance provided by OpenTheBooks.com in compiling federal grant data for fiscal year 2017, which provided the impetus for this research. This piece is the conclusion of CRC’s first investigation exploring the funding of nonprofit organizations by the federal government.

In its 2019 Budget in Brief, the Department of Labor declined to request any funding for the SCSEP, stating instead that the program is “ineffective at meeting its purpose of transitioning low-income unemployed seniors into unsubsidized jobs.” Elaborating, it explained that “[a]s many as one third of SCSEP participants fail to complete the program and, of those who do, only half successfully transition to unsubsidized employment.” Undoubtedly, this is a repudiation of the program by the Trump administration, but it is not one without some bipartisan precedent. In 2015, President Obama submitted a budget proposal that would have reduced the program’s budget by just under 13%. While this is a far cry from calling for the program’s elimination, it perhaps reflects a growing understanding of the program’s inefficiencies. Such conclusions appear to be supported by recent tax filings of the grantee organizations examined by CRC.

One 501(c)(3) nonprofit almost entirely funded by the SCSEP is Vermont Associates for Training and Development. In its 2017 IRS Form 990, it claimed to be a “top performing grantee” of the program due to its 52% transition rate to unsubsidized employment, with a subsequent 70.8% retention rate. Another, VANTAGE Aging (formerly known as Mature Services, Inc.), reported in its 2016 Form 990 that “[i]n 2016, 141 people found work as a result of training they received in the program.” According to an audit covering the same period in 2016, VANTAGE received over $8.7 million for the SCSEP during that period. This would translate to a cost of $62,000 in program funds per successful job seeker. Even allowing for the possibility that these numbers don’t fully reflect some of the other ways participants may have benefited from the program, or that perhaps there is a year-over-year delay between program participation and a job-seeker’s ultimate success, those figures still represent a high cost to the taxpayer when the ultimate goal is worker self-sufficiency.

It shouldn’t come as too much of a surprise that the Department of Labor has suggested that the broad objectives of the SCSEP could be better-met through other means. Specifically, they point to the Workforce Innovation and Opportunity Act (WIOA). This legislation, which went into effect in 2015, authorizes a number of program activities aimed at multiple demographics with a broad goal of helping to train job applicants and then match them with prospective employers. In recent years WIOA-authorized programs have received funding in excess of $3 billion, though the Department’s request for 2019 was closer to $2 billion.

Despite the lack of support from the Department of Labor, the SCSEP has continued to be included in the budget every year. Congressional support for its continuance is evidenced in a May 2017 letter signed by 23 Democratic Senators urging “robust” funding of the program in fiscal year 2018. This effort was spearheaded by Senator Chris Murphy (D-CT), and prominent supporters include Senators Bernie Sanders (I-VT), Tim Kaine (D-VA), Elizabeth Warren (D-MA), Kirsten Gillibrand (D-NY), and Dianne Feinstein (D-CA). It should be noted that, according to Congressional disclosures, a number of the nineteen nonprofits that administer SCSEP funds are engaged in lobbying, including four that are majority-funded by either the SCSEP or the SEEP: Experience Works, Senior Service America, the National Older Worker Career Center, and the National Council on Aging.

This is not in and of itself a problem; 501(c)(3) tax-exempt organizations may engage in a limited amount of lobbying, provided it does not rise to become a “substantial part” of that nonprofit’s overall activities. One might also quite reasonably expect an organization whose very existence depends on the continuance of one or two government programs to lobby for those programs’ continued funding. Still, when taxpayer dollars are at issue, the overriding question must be whether the money is being spent in the most effective way to achieve the desired objectives. In the case of the Senior Community Service Employment Program, the answer is likely “no.”

Finally, while the nonprofit organizations that administer the SCSEP and the SEEP are themselves nonpartisan, in some cases their leadership is decidedly less so. The National Association for Hispanic Elderly counts among its leadership two board members who have had roles in the Democratic National Committee, as well as the former President of the Los Angeles County Federation of Labor (AFL-CIO). Senior leadership at the National Caucus & Center on Black Aging have, between them, worked at one point or another for at least four Democratic members of Congress. The National Urban League—a major recipient of SCSEP funds—is a member of several large progressive coalitions and is headed by Marc Morial, the former Democratic mayor of New Orleans (as an aside, tax filings report Mr. Morial’s total President/CEO compensation as a whopping $900,000 in 2016—a year in which the National Urban League received over 30% of its revenue from the government). Even the National Council on Aging, an organization that relies on government grants (including tens of millions in SCSEP/SEEP money) for over 70% of its revenue, is a client of Lake Research Partners—a left-wing consultancy headed by “one of the Democratic Party’s leading political strategists,” Celinda Lake, and whose mission is to “work with our clients to advance progressive ideals.” While not the case in every instance, many of these nonprofits appear to skew leftward in practice.

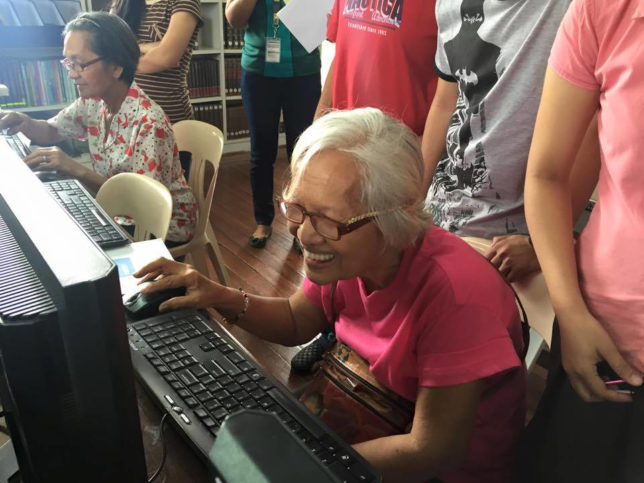

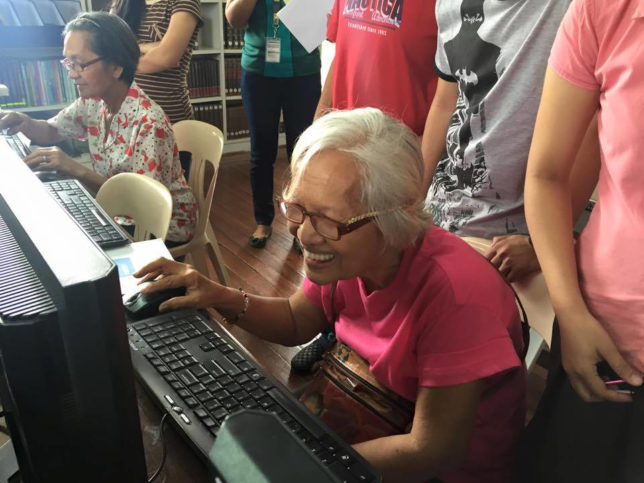

It’s important to remember that criticism of a particular government program does not equate to criticism of that program’s objectives. We live in the most dynamic employment environment in our history. Basic skills that many would consider indispensable to an applicant’s employability in 2019 might not seem so basic when one remembers those skills may have been highly specialized or even nonexistent just a generation or two ago. Senior citizens, especially those with inconsistent work records, are among the most vulnerable workers in today’s labor market. The question isn’t whether they could use the help; it’s whether the help they’re receiving is making the best use of far over-stretched government resources. And, while efficiency and effectiveness often play second fiddle to expediency and appearances in the Beltway, that doesn’t mean we shouldn’t remain vigilant for situations where vested interests—like government-funded nonprofits—might be the life support behind an ailing program that, if allowed to die, could potentially be born again and help more people in the process.

This is the first of many analyses between nonprofit organizations which receive federal funds from government agencies. Stay tuned for more Special Reports on federal grants and taxpayer-funded programs using data provided by OpenTheBooks.com.