Organization Trends

The IRS Attacks the Tea Party

(PDF here)

Summary: Left-wing activists like the Soros-backed ProPublica group helped Lois Lerner’s IRS persecute and harass conservative nonprofits that were seeking tax-exempt status.

The great Daniel Webster famously remarked that the power to tax is the power to destroy. Webster’s words are as true today as they were 200 years ago. But the Obama administration, an endless source of innovation in political corruption, found a way to wield as a weapon against its political enemies the power to grant tax-exempt status.

The Left favors cracking down on conservative nonprofits because there are so many of them fighting the progressive agenda. ProPublica, a left-wing “investigative journalism” outfit, opined in a Dec. 14, 2012 article: “Politically active social welfare nonprofits like Crossroads have proliferated since the Supreme Court’s Citizens United decision in January 2010 opened the door to unlimited political spending by corporations and unions.”

It’s just not fair that conservative nonprofits are so skilled at nonprofit activism, the left-wing media outlet implied: “Earlier this year, a ProPublica report showed that many of these groups exploit gaps in regulation between the IRS and the [Federal Election Commission], using their social welfare status as a way to shield donors’ identities while spending millions on political campaigns. The IRS’ definition of political activity is broader than the FEC’s, yet our investigation showed many social welfare groups underreported political spending on their tax returns.”

Of course that depends on the definition of “political spending.” Educating the public isn’t necessarily political spending, but in the Left’s calculus all money spent by right-leaning groups is worthy of scrutiny.

The Left is also terrified of what it calls “dark money” because its operatives want to know whom to attack. Anonymous charitable donations, which are a form of political speech protected by the First Amendment, are characterized as suspicious and un-American. Left-wingers use words such as “transparency” as an excuse to silence disfavored speech. (So-called dark money was examined in Organization Trends, September 2015.)

In 2013 the American public learned that President Obama used the Internal Revenue Service to vex and harass his political opposition. That Obama’s IRS singled out conservative groups for special scrutiny ought to “send a chill” up Americans’ spines, then-House Intelligence Committee chairman Mike Rogers (R-Mich.) told Fox News. The tax-collection agency’s strong-arming of political organizations “is as dangerous a problem the government can have.”

“This is something that we cannot let stand. It needs to have a full investigation.”

Cheered on by Rep. Elijah Cummings (D-Md.), a reliable Obama attack dog, the IRS exempt organizations branch brutally harassed conservatives like Catherine Engelbrecht, leader of the Houston-based good-government group True the Vote. Other federal agencies joined in the harassment campaign, subjecting Engelbrecht’s family business to unexpected audits, inspections, and fines.

Left-wing Democrat Lois G. Lerner, then the director of the Exempt Organizations Division at the IRS, did the Obama administration’s bidding, harassing conservative groups and funders. Lerner testified before Congress, and after protesting her innocence she suddenly invoked the Fifth Amendment and refused to continue testifying.

But earlier Lerner had confirmed the IRS abuses. IRS employees in the agency’s Cincinnati office targeted conservative 501(c)(4) groups, she said. Section 501(c)(4) of the Internal Revenue Code exempts nonprofit organizations “operated exclusively for the promotion of social welfare” from having to pay federal income tax. The IRS allows 501(c)(4) groups to engage in lobbying and political campaign activities if those activities are not the organization’s primary activity. Two of the most high-profile 501(c)(4) groups are the left-leaning Organizing for Action (which is simply a continuation of the Obama presidential campaign) and the right-leaning Crossroads GPS (which was founded by GOP political consultants, including Karl Rove).

Such 501(c)(4) groups are allowed to be more overtly political in their activities than the most common form of nonprofit, the 501(c)(3), which includes public charities like the Salvation Army and private foundations like Ford and Rockefeller. Consequently, donors to 501(c)(4) organizations are not allowed to deduct their donations from their income taxes, whereas donors to 501(c)(3) groups are allowed to make such adjustments.

Lerner admitted that groups that included the words “tea party” or “patriot” in their documents were singled out for heightened scrutiny. Yet she denied that orders to make conservative activists’ lives difficult had come from on high in Washington.

Nobody buys that line, especially given President Obama’s frequent promises to dole out punishment to his opponents. The very fact that Lois Lerner isn’t in prison right now is proof of political interference at the highest levels. Lerner lied to Congress, committed contempt, and engaged in obstruction of justice on a massive scale. Yet nothing happened to her.

At the same time, left-wing nonprofit groups went all-out to protect the Obama administration. Propaganda outlets Media Matters for America and ThinkProgress dutifully attacked those who demanded the truth be told, while investigative outfits like ProPublica worked hand-in-hand with the IRS in the effort to hurt conservative activist groups.

The Targeting Scandal

Before examining the role that those left-wing nonprofits played in the saga, some background is necessary. In the lead-up to the 2012 election, many conservative organizations and Tea Party groups that had sought tax-exempt status from the IRS were frozen in limbo, unable to participate fully during election season because they were wasting away on an IRS list specifically created to stymie right-leaning groups hostile to President Obama’s radical left-wing agenda.

In spring 2013, the IRS admitted to using keywords to target conservative organizations seeking tax exemption. The agency said it used the keywords as a way to quickly flag applications for closer scrutiny because, after the First Amendment-affirming Citizens United ruling in 2010, the IRS was overloaded with applications.

Some of the keywords used to target conservative groups included “Tea Party” and “patriots,” as well as the word “Israel.” Other key phrases and concepts used by the IRS to apply a heightened level of scrutiny included questioning government spending, government debt, government capability, or criticizing how the country was being run, advocating for education about the Constitution or the Bill of Rights, and any challenges to the Affordable Care Act (a.k.a. Obamacare).

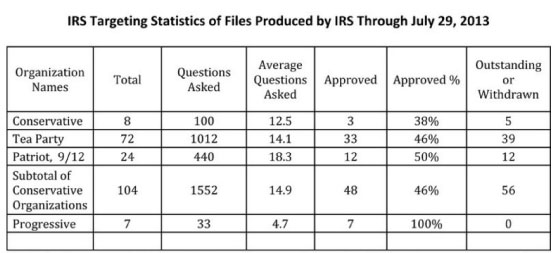

Table 1

There is no comprehensive list of the groups targeted because the IRS destroyed storage media containing information relevant to the scandal. But an NPR report summarizing findings by the House Ways and Means Committee eloquent testifies to the abuse conservative groups suffered. (See table 1, “IRS Targeting of Files Produced by IRS Through July 29, 2013.”)

The IRS claims in its defense that lower-level employees at its Cincinnati office took it upon themselves to use these keywords and key phrases to flag applications and that no upper management, such as Lerner, had instructed them to subject conservative groups to enhanced scrutiny.

But Lois Lerner’s unprecedented stonewalling of congressional committees underlined her guilt. It didn’t help her case that the IRS was unable to turn over most of her emails requested during the investigation, because the emails had been mysteriously destroyed. However, some of the few emails recovered and made public showed Lerner condemning and lambasting conservatives. She called the Tea Party “very dangerous” and used obscenities when referring to politically conservative radio hosts.

Even more suspiciously, Lerner’s hard drive had supposedly crashed and therefore could not be used in the investigation. Over 400 electronic backup tapes had also been destroyed and could not be used either.

Left-wing groups to the rescue

As the scandal unfolded, left-wing nonprofits came to the aid of Obama by pushing false narratives.

In full cover-up mode, Media Matters for America posted many items attacking whistleblowers and insinuating that the Republican investigators involved were unethical. Among the posts were: “The IRS ‘Scandal’ Was A Scam” (June 26, 2013); “Fox News Pushes Issa’s Selective Interview Leaks, Ignores Calls To Release All Transcripts” (June 17, 2013); “Debunked Right-Wing Myths Persist In State Newspapers” (June 2, 2014); and “Fox Twists Loss Of IRS Emails Into Nefarious Conspiracy” (June 18, 2014).

ThinkProgress, an online scandal sheet published by the John Podesta-founded Center for American Progress Action Fund, attacked those trying to hold the Obama administration to account. Among its many posts were “Fox News Host Grills House Republican On Fruitless IRS Investigations” (April 13, 2014); and “CNN Host Corners Darrell Issa Over Claim That Obama Conspired To Target Tea Party” (June 2, 2013).

ThinkProgress, founded and edited by the ethically challenged Judd Legum who previously served as research director for Hillary Clinton’s presidential campaign, also pushed outright lies. The Left’s Big Lie used to deflect attention from the Obama administration’s role in the targeting was promoted in an article titled, “New Records: IRS Targeted Progressive Groups More Extensively Than Tea Party” (April 23, 2014). Actually, the Treasury Department’s own Inspector General wrote congressional Democrats that 292 conservative groups were targeted by the IRS, compared to six center-left groups.

Media outlet ProPublica became directly involved in the targeting scandal. It acknowledged that the IRS tax-exempt organizations division sent confidential information about 31 conservative groups to it (Daily Caller, May 14, 2013).

“The same IRS office that deliberately targeted conservative groups applying for tax-exempt status in the run-up to the 2012 election released nine pending confidential applications of conservative groups to ProPublica late last year,” ProPublica stated in a report.

It continued:

“In response to a request for the applications for 67 different nonprofits last November, the Cincinnati office of the IRS sent ProPublica applications or documentation for 31 groups. Nine of those applications had not yet been approved—meaning they were not supposed to be made public. (We made six of those public, after redacting their financial information, deeming that they were newsworthy.)”

“Before the 2012 election, ProPublica devoted months to showing how dozens of social-welfare nonprofits had misled the IRS about their political activity on their applications and tax returns. … In 2012, nonprofits that didn’t have to report their donors poured an unprecedented $322 million into the election. Much of that money—84 percent—came from conservative groups.”

The six groups were Karl Rove’s Crossroads GPS, Americans for Responsible Leadership, Freedom Path, Rightchange.com II, America Is Not Stupid, and A Better America Now.

In late 2012, Crossroads then-spokesman Jonathan Collegio responded to ProPublica pointedly in an email. “As far as we know, the Crossroads application is still pending, in which case it seems that either you obtained whatever document you have illegally, or that it has been approved.”

As Cheryl K. Chumley noted in the May 2009 Foundation Watch, ProPublica was created in 2007 to serve as “a media outlet that will produce left-wing ‘investigative’ hit pieces that can be given to cash-strapped newspapers at no cost.”

The nonprofit was founded with a reported $10 million in seed money from Herb and Marion Sandler, the toxic mortgage king and queen who also bankrolled the notorious Association of Community Organizations for Reform Now (ACORN). Herb Sandler (Marion died in 2012) is also a key member of Democracy Alliance, the George Soros-led billionaires’ club that aims to push America farther to the left through strategic giving to left-wing groups and institutions. (For more on the Sandlers’ giving, see Foundation Watch, February 2015.)

Other members of the left-wing philanthropic establishment funding ProPublica include: Pew Charitable Trusts ($1,500,000 since 2010); John S. and James L. Knight Foundation ($1,019,000 since 2013); Ford Foundation ($550,000 since 2013); Stephen M. Silberstein Foundation ($500,000 since 2011); John D. & Catherine T. MacArthur Foundation ($250,000 since 2011); and Tomkat Charitable Trust (named for mega-donor Tom Steyer and his wife, $200,000 since 2013).

After Paul E. Steiger, a former managing editor at the Wall Street Journal, was named ProPublica’s president and editor-in-chief he said the organization would “shine a light on exploitation of the weak by the strong and on the failures of those with power to vindicate the trust placed in them. We will be non-partisan and non-ideological, adhering to the strictest standards of journalistic impartiality and fairness.”

But instead of siding with the politically weak Tea Party groups, ProPublica allied itself with power, cooperating with the IRS and the out-of-control Obama administration.

Aftermath

On Oct. 23, 2015, the nearly two-and-a-half year investigation into the scandal by the U.S. Department of Justice found that Lerner and the IRS were not guilty and that no criminal charges would be filed. Justice’s official statement added the proviso that even though Lerner and the IRS undeniably botched the process, they committed no crimes.

“Our investigation uncovered substantial evidence of mismanagement, poor judgment and institutional inertia, leading to the belief by many tax-exempt applicants that the IRS targeted them based on their political viewpoints,” Assistant Attorney General Peter Kadzik said. “But poor management is not a crime.”

Kadzik said DoJ could not prove that IRS officials had “intentionally discriminated against an applicant based upon viewpoint” but instead came to the conclusion that low-level employees’ “ignorance” and “negligence” were the reason for the backlog of hundreds of conservative organizations’ applications for 501(c)(3) and 501(c)(4) status. However, emails made public between IRS officials seem to show that the employees were following instructions from Washington to continue to put on hold the conservative applications that had been flagged.

Former Justice Department staff attorney J. Christian Adams said Lerner was never in legal jeopardy with Obama in the White House. “She’s part of the elite, insider, left-wing, five-bedroom-house-in-Bethesda crowd,” he said of Lerner and the fancy Maryland suburb of Washington in which she lives. “And so nothing was going to happen to her because she goes to the right cocktail parties.” The decision not to proceed against Lerner shows that being prosecuted for crimes “is for little people.”

Robert Knight of the American Civil Rights Union said Lerner’s misdeeds helped President Obama secure a second term because Tea Party groups weren’t able to get organized while their tax-exempt status hung in limbo.

“What Lois Lerner did moves us that much closer to being an authoritarian third world-type country, where might makes right,” Knight said. “It’s un-American. She should have been indicted. It’s a disgrace.”

Not long after the DoJ ended the investigation, 19 members of the House Oversight and Government Reform Committee called for the impeachment of IRS Commissioner John Koskinen, a longtime Democrat apparatchik appointed by Obama in 2013. The lawmakers claimed that Koskinen lied under oath to Congress and that he allowed the destruction of evidence when thousands of Lerner’s e-mails were mysteriously erased, thus hindering the investigation.

The committee claimed that Koskinen “failed to comply with a congressionally issued subpoena, documents were destroyed on his watch, and the public was consistently misled. Impeachment is the appropriate tool to restore public confidence in the IRS and to protect the institutional interests of Congress.”

Meanwhile, President Obama said in a Super Bowl weekend interview that not even “a smidgen of corruption” existed or would be found during the investigation into IRS the scandal.

Lerner refused to resign after lawmakers repeatedly demanded she do so after the scandal first came to light. She instead was placed on administrative leave until Sept. 23, 2013 when she officially retired from her position as head of the IRS’s tax-exempt division. She received her full pension and benefits upon retiring.

The Speaker of the House of Representatives, Paul Ryan (R-Wis.), said that while the Department of Justice’s decision is “predictable coming from this administration,” it is still “deeply disappointing.”

“Serious and unprecedented actions taken by the most senior IRS official in charge of the non-profit unit, Lois Lerner, deprived conservative organizations of their constitutional rights,” Ryan said. “The American people deserve better than this.”

The previous House Speaker, John Boehner (R-Ohio), agreed with Ryan. “My question isn’t about who’s going to resign,” Boehner said, “My question is who’s going to jail over this scandal? Someone made a conscious decision to harass and to hold up these requests for tax-exempt status. I think we need to know who they are and whether they violated the law. Clearly someone violated the law.”

Mark Meckler, president of Citizens for Self-Governance, one of the Tea Party groups affected by the scandal, said the DoJ’s decision “is a whitewash and miscarriage of justice at the highest levels of law-enforcement where they put political interests over the First Amendment, the Constitution and the American people. It’s no wonder why so many Americans have had it with Washington and the elite political class who can get away with something like this.”

Rep. Jason Chaffetz (R-Utah), chairman of the House Oversight Committee, said, “This announcement is a reminder that the Obama administration continues to refuse to hold anyone accountable at the IRS. A clear message must be sent that using government agencies to stifle citizens’ freedom of speech will not be tolerated. If the administration won’t send that message, Congress will.”

Republicans were not the only ones disappointed by the DoJ’s decision; some liberals were upset as well. For example, MSNBC talking head Rachel Maddow agreed that the targeting of conservative groups was “not fair,” and she added, “There is a reasonable fear by all of us, by any of us, that the kind of power the IRS has could be misused.”

Also from MSNBC, Joe Scarborough called the IRS scandal an example of “tyranny,” saying the IRS abuses were “real” and “unspeakable.”

Chuck Todd, a White House correspondent for NBC, observed that “It didn’t seem like [the White House] had a sense of urgency about it, a real sense of outrage.” Todd said the scandal was “outrageous no matter what political party you are.”

Terry Moran from ABC News called the scandal “A truly Nixonian abuse of power by the Obama administration.”

And the most liberal of them all, Comedy Central’s Jon Stewart, said the scandal creates doubt about President Obama’s “managerial competence” and takes away “the last arrow in your pro-governance quiver.”

Lori Lowenthal Marcus, president of Z Street, one of the conservative groups targeted by the IRS, believes that “The Obama administration is trying to punish any group with a different view point from theirs.”

Z Street, a pro-Israel group, is now suing the IRS for unconstitutional discrimination. Marcus believes that the IRS “gave differential treatment to tax exemption applications from organizations holding views about Israel inconsistent with those espoused by the Obama administration.”

Z Street filed its suit in fall 2010 after it learned of the discriminatory IRS “Israel Special Policy.” In Z Street v. Koskinen, Z Street claims that this “special policy” constitutes viewpoint discrimination and therefore violates the group’s First Amendment rights.

“The IRS didn’t come up with this idea on their own,” Marcus believes. “The Obama administration has particular views on Israel that Z Street does not share.” She adds that “Groups like Z Street believe that Jews are allowed to live in disputed territories [the West Bank] and Israel. The Obama administration does not agree.”

Marcus argues that her “constitutional rights were violated. The IRS has violated the constitution. The IRS is blocking Americans from being able to exercise their constitutional rights, they have blocked us from being able to educate about Israel.”

Obama not the first to use the IRS as a weapon

The Internal Revenue Service was not always a tool for despots. The IRS was created in 1862 and was known originally as the office of the Commissioner of Internal Revenue. President Abraham Lincoln established the office because a temporary income tax was needed to help pay for the Civil War.

This wartime income tax only lasted a decade, and in 1894 the Supreme Court ruled that a federal income tax was unconstitutional. It was not until the 16th Amendment was ratified in 1913 that Congress was given the power to enact an income tax.

The IRS served its purpose of collecting taxes more or less from 1913 until 1933, when Franklin D. Roosevelt assumed the presidency. During his administration (1933 – 1945) the power of the IRS was abused on a large scale for perhaps the first time.

FDR regularly used the IRS to target his political enemies. His own son, Elliott Roosevelt, said his father “may have been the originator of the concept of employing the IRS as a weapon of political retribution.”

Elliott’s harsh claims are backed up by evidence. On many occasions FDR abused his presidential powers by using the IRS to punish those who were against him politically. The president needed more money for the New Deal programs he had begun to create, so in 1935 so he spearheaded an increase in the top income tax rate to 79 percent and in the top estate tax rate to 70 percent.

One of FDR’s first targets, Huey Long, the former governor of Louisiana and a member of the U.S. Senate from 1932 until 1935, underwent a painstaking investigation by the IRS because he criticized the president and his policies. FDR called Long one of the most dangerous men in the United States and instructed the IRS to investigate Long after rumors began to spread that Long could challenge FDR for a future Democrat presidential nomination. This was the beginning of Roosevelt’s using the IRS as a tool to kneecap political opponents.

Media baron William Randolph Hearst also opposed FDR’s policies and found himself on the receiving end of a nasty IRS investigation.

Hamilton Fish, a Republican congressman, was another who criticized Roosevelt. Fish was also “coincidentally” investigated by the IRS, not once but twice. The first time, the IRS accused Fish of owing thousands of dollars in taxes, but a judge found the accusation to be false. FDR was not satisfied with this outcome so another IRS audit was started, this time lasting many years, but again Fish was proven not to be breaking the law.

Roosevelt abused his presidential powers again in 1944 when an IRS investigation into future president Lyndon Johnson was suddenly halted. Johnson had not been accurately reporting campaign finances, so the investigation was warranted. Roosevelt realized that Johnson could be valuable to him down the road so he instructed the IRS to drop their investigation.

It was not long before some of the wealthiest in the country became predictable targets of Roosevelt. Andrew Mellon, an industrialist who had become one of the wealthiest men in the United States, became a target of an enormous and merciless IRS investigation after his political actions upset Roosevelt. The two men disagreed greatly on policy.

Another wealthy Republican, Moe Annenberg, became the object of one of Roosevelt’s obsessive IRS investigations. However, this time, Roosevelt’s target was actually guilty and owed the government millions of dollars. Annenberg said he would pay the government back every penny owed, but Roosevelt demanded he be sentenced to jail. Roosevelt wanted to remind other rich Republicans of the power that he had and was not afraid to use.

The Lois Lerner affair prompted some commentators to draw parallels with President Richard Nixon, noting he came dangerously close to impeachment for unleashing the IRS on his enemies.

On July 27, 1974, the House Judiciary Committee approved on a vote of 28 to 10 an article of impeachment that accused Nixon of using the nation’s tax-collection agency to punish his enemies. Facing seemingly certain impeachment in the House and removal from office by the Senate, Nixon resigned two weeks later.

But Nixon has been oversold as a villain.

The second article of impeachment against Nixon detailed how he allegedly used the IRS and other federal agencies and their employees against those he perceived as his political enemies.

According to the impeachment resolution, Nixon used the IRS to obtain “confidential information contained in income tax returns for purposes not authorized by law, and to cause, in violation of the constitutional rights of citizens, income tax audits or other income tax investigations to be initiated or conducted in a discriminatory manner.”

Although Nixon reportedly encouraged a clandestine IRS program called the “Special Services Staff” to probe his political adversaries and plague them with audits, the tax-collection agency’s bark at the time was apparently worse than its bite where Democrats were concerned.

Nixon endorsed but then quickly backed away from an ambitious crackdown on left-wing organizations urged by his aide, Tom Charles Huston. Nixon approved Huston’s plan on July 14, 1970 but by July 27 he had changed his mind and rescinded approval for it after FBI director J. Edgar Hoover voiced objections.

Huston later lamented that dealing with the IRS was fraught with peril. “Making sensitive political inquiries at the IRS is about as safe a procedure as trusting a whore,” since the Nixon administration at the time had no “reliable political friends at IRS.”

Later in September 1971 Nixon ordered White House aide John Ehrlichman to direct the IRS to look into the tax returns of all those thought to be seeking the 1972 Democratic presidential nod, including Sen. Ted Kennedy (D-Mass.).

“Are we going after their tax returns?” Nixon said. “You know what I mean? There’s a lot of gold in them thar hills.”

Nominated as IRS commissioner by Nixon, Johnnie Mac Walters headed the IRS from Aug. 6, 1971, to April 30, 1973. Nixon White House counsel John Dean gave Walters an envelope containing the names of about 200 prominent Democrats to harass.

Walters refused to target the individuals. “The story is interesting because the IRS wouldn’t do it,” said Tim Naftali, former director of the Richard Nixon Presidential Library and Museum. “It didn’t happen, not because the White House didn’t want it to happen, but because people like Johnnie Walters said ‘no.’”

Even if he had used the IRS in the way described in the second article of impeachment, he was simply doing what presidents had done for the previous 40 years. This is not to excuse Nixon’s behavior, but it hardly seems fair to single him out for doing what had long been the norm in Washington.

The first known instance of an administration snooping around in its enemies’ tax records for intelligence purposes happened during the presidency of Republican Herbert Hoover (1929-33). FBI director J. Edgar Hoover tried to dig up dirt on a conservative group called the Navy League. He found nothing.

Surprisingly, even if the FBI chief had found anything, his actions were apparently not unlawful. The “confused drafting” of a section in a 1910 appropriations act “actually authorized presidents to use tax records any way they saw fit,” writes David Burnham, the liberal author of A Law Unto Itself: Power, Politics, and the IRS. The 1910 law stated that tax records “were to be open for inspection ‘only upon the order of the President under rules and regulations to be prescribed by the Secretary of the Treasury and approved by the president.’”

What next?

The Obama administration continues to plot against conservative groups.

President Obama’s IRS is still holding nonprofit applications from conservative and Tea Party groups hostage even now, years after the IRS targeting scandal first made headlines. The IRS remains a powerful instrument of political repression in the hands of Obama. Always on the hunt for new ways to disadvantage his political adversaries, Obama is also now moving forward with a fresh campaign of political intimidation against nonprofit groups that strikes at the heart of the American democratic process.

Ominously, IRS boss John Koskinen has vowed “to have new rules to limit political activities of nonprofit organizations in place before the 2016 election, raising the specter of another major fight over the tax agency and political targeting,” the Washington Times paraphrased Koskinen saying. The IRS already tried to impose a rule preventing nonprofits from running voter registration drives (which is currently legal if done on a “nonpartisan” basis), but backed down in the face of a public backlash.

Disclosure Attacks

J. Christian Adams warns that the Obama administration is inventing new ways to stick it to nonprofit groups, forcing those organizations to reveal their donors, even though that is not required by federal law or IRS regulations. Coerced disclosure “has no purpose other than to try to open up the donors of such organizations to harassment and intimidation for their political and social beliefs in associating with particular membership organizations,” according to Adams. The Federal Election Commission “has no statutory authority to mandate such disclosure of organizations that are not political committees.” And the leading Supreme Court case on the issue, NAACP v. Alabama (1958), forbade such disclosures, which were then being sought from civil rights groups that were suffering harassment from state and local governments run by Democrats. (For more on current left-wing efforts to harass donors through “disclosure,” see Organization Trends, September 2015.)

The Left’s “accountability” actions focus on harassing and intimidating political enemies, disrupting their activities, and forcing them to waste resources dealing with activists’ provocations. It is a tactic of radical community organizers, open borders fanatics, and union goons. Taking a cue from Marxist theorist Herbert Marcuse, they want to shut down, humiliate, and silence those who won’t quietly submit to their policy agenda.

And left-wing groups like ProPublica, Media Matters, and ThinkProgress stand ready to help government bureaucrats push conservatives around.

Joely Friedman is a senior studying journalism at the Ohio State University. She is also president of the OSU chapter of the Society of Professional Journalists. This paper draws from articles published by FrontPageMag.com that were researched and written by Capital Research Center senior vice president Matthew Vadum; passages therefrom are reprinted with permission.

OT