Organization Trends

Insuring Crony Capitalism

(PDF here)

Summary: Obamacare was originally passed into law with the help of payoffs to industries in health care. Now the law’s machinery encourages each part of the medical sector to advocate for policy twists that benefit their group at the expense of other groups—and of consumers above all. For instance, the insurance industry wants to use government to squeeze drug makers, and part of this campaign involves a “nonpartisan” nonprofit think tank that’s designed to persuade the public that price controls on drugs will be swell. Actually, the history of price controls proves the opposite. If Americans want both innovation and incentives for lower prices, they will have to substitute competition in the marketplace for government-run health care.

The year 2009 must seem like the halcyon days for the health care industry and crony capitalism. The process of passing a health care overhaul, eventually dubbed Obamacare, through Congress provided stakeholders in the health care industry ample opportunity to use the government to their advantage. Instead of trying to convince consumers to purchase their products and services—i.e., instead of competition via the marketplace—health care companies would support government policies that forced people to purchase their products and used subsidies from taxpayers to lessen the pain of the purchase.

It seemed there was something for almost every stakeholder. As the saying went during the debate over Obamacare, “Better to be at the table than on the table.” The insurance companies secured an individual mandate that requires most Americans to purchase their services. Other goodies for insurers included government subsidies to help people purchase health insurance and a bailout—called a “risk corridor”—for insurers who lose money in the Obamacare exchanges during their first three years of operation. In return, the insurance industry trade group, America’s Health Insurance Plans (AHIP), publicly backed the bill, and insurance companies spent millions of dollars lobbying for it.

The pharmaceutical industry made out pretty well too. Prescription drugs were one of the “essential benefits” that Obamacare mandates all “qualified” health insurance must cover. Through the benefit mandate, the pharmaceutical industry was getting an in-kind subsidy for its products. The pharmaceutical industry also received a promise from the Obama administration that the amount it would have to contribute to health care reform would not be more than $80 billion over 10 years, down from an initial $100 billion. The pharmaceutical industry’s quid pro quo was a $150 million advertising campaign in 2009 backing Obamacare.

Those days are over. As 2016 dawns, one section of the health industry is flirting with another type of crony capitalism: using government regulation to hamstring some market players for the benefit of others. Specifically, the insurance industry, with a big assist from the political Left, is supporting more government regulations on the pharmaceutical industry, new mandates that could ultimately lead to price controls.

Such price controls would no doubt boost insurance industry profits by artificially lowering the price of the prescription drugs that insurers must cover. Yet price controls invariably have nasty side effects, such as shortages and decreased investment. For patients, this could mean difficulty in getting much needed pharmaceuticals in a timely manner, and fewer new drugs that better treat disease. Expect this sort of crony capitalism in the health care industry to continue as long as Obamacare is the law of the land.

Trouble Ahead For Insurers?

It’s not surprising the health insurance industry would want to use the powers of government against the pharmaceutical industry. While both industries publicly supported Obamacare, the insurance industry played both sides of the aisle. AHIP secretly funneled over $100 million to the U.S. Chamber of Commerce to run advertisements opposing Obamacare. The insurance industry seems to be the cagier of the two.

The insurance industry is pursuing more crony capitalism due to three developments in the last two years. First, despite the individual mandate and subsidies to purchase health insurance, few insurers are making any money on the Obamacare exchanges. In June 2015, Time Insurance announced it would be leaving the exchanges at the end of 2016 if it couldn’t find a buyer for its business. As the summer wore on, it became clear that over half of the 23 exchange “Co-Ops”—nonprofit insurers launched with grants from the federal government—had either failed or announced they were closing. In November, UnitedHealth Group, one of the biggest insurers on the exchanges with over 500,000 customers, announced it may abandon the exchanges. UnitedHealth CEO Stephen Hemsley said, “We see no data pointing to improvement” in the exchanges. If one of the nation’s biggest insurers can’t make a profit on the exchanges, it’s doubtful many other insurers will either.

Second, the risk corridors are not bailing out the insurers. Sparked by public outrage, congressional Republicans succeeded in inserting language into the last two federal budgets that prevents any taxpayer funds from going to the risk corridors.

Finally, pharmaceutical spending jumped over 13 percent in 2014 according to the company Express Scripts. This followed years of small increases in drug costs. To listen to the insurance industry and groups on the Left, the biggest culprits are Sovaldi and Olysio, new drug treatments for hepatitis C. Both drugs have shown cure rates of 80 to 90 percent and have far fewer side effects than other treatments. Yet they are expensive. A course of Sovaldi runs to about $84,000, or about $1,000 a pill. Olysio costs about $66,000. Express Scripts estimates that these two drugs were responsible for an $11 billion increase in drug spending.

There have also been instances of pharmaceutical companies charging much higher prices for drugs that have made headlines. In February 2015, Valeant Pharmaceuticals International purchased the rights to two heart drugs, Nitropress and Isuprel, and then raised their prices by 525 percent and 212 percent, respectively. In September, Turing Pharmaceuticals raised the cost of an AIDS drug from $18 to $750 per pill.

These incidents have provided a nice intersection of interests for the Left and the insurance industry. Higher drug prices have provided an opportunity for groups on the Left that have long wanted price-control regimes on pharmaceuticals similar to those in Canada and European nations. For the insurance industry, price controls would help hold down their costs at a time when they may soon be struggling to keep their bottom lines from veering into the red.

The Campaign for Pharmaceutical Price Controls

On its website AHIP cites the introduction of new hepatitis C drugs as examples of “unaffordable and unreasonable drug pricing” and “a major driver of skyrocketing prescription drug spending in 2014.” It further lauds members of Congress for holding hearings on the issue and urges drugmakers to heed the message that their prices are too high.

The website also quotes a Steven D. Pearson about Sovaldi. “It could be the right thing to do clinically, but at this price, can we afford it?” he says. Pearson is the president of what may be the insurance industry’s most effective weapon in this campaign, the Institute for Clinical and Economic Review (ICER). A medical doctor with an impressive pedigree, Pearson founded ICER in 2006 with a $430,000 grant from the Blue Shield of California Foundation.

ICER researches the evidence on the effectiveness of various medical treatments, including prescription drugs, medical devices, surgeries, and innovations in the health care delivery system. To achieve this goal, ICER “performs analyses on effectiveness and costs; develops reports using innovative methods that make it easier to translate evidence into decisions; and, most distinctively, fills a critical gap by creating sustainable initiatives with all health care stakeholders that can align efforts to use evidence to drive improvements in both practice and policy,” according to its website.

ICER’s stated mission is potentially very useful. An independent organization in the private sector that examines the efficacy of medical treatments can help hospitals, physicians, and patients not only in deciding which treatments are effective but also in weighing the costs and benefits of those treatments. But such an organization should receive funding from a wide array of health care groups, from the insurance industry, to the pharmaceutical industry, to medical device manufacturers, and so on. This would increase the likelihood that the organization would focus on objective research and not take policy positions that are helpful to one industry at the expense of another.

To be fair, ICER’s website does list among its donors some pharmaceutical companies and medical device manufacturers. Yet far more of its funding appears to come from the insurance industry. ICER lists 12 insurance companies, foundations, or trade associations as funders, including United HealthCare, the Aetna Foundation, and AHIP. In 2013, ICER reported about $437,000 in revenues and $1.6 million in assets. It also received a grant of $850,000 from the Blue Shield of California Foundation that, for auditing purposes, was reclassified as deferred revenue. (For a nonprofit, deferred revenue is money received that will be spent on work in the future.) Had the grant from the foundation been deemed regular revenue, it would have accounted for nearly two-thirds of ICER’s contributions received for 2013.

One project ICER administers is called the California Technology Assessment Forum (CTAF). Like ICER, CTAF reviews evidence of the effectiveness of medical treatments. CTAF was initially a project of the Blue Shield of California Foundation before it was transitioned to ICER in 2013. In 2013, the foundation provided direct charitable support to CTAF, although the exact amount was not listed in IRS filings.

Of the pharmaceuticals it has examined thus far, ICER has determined that most are too expensive. An ICER report on two cholesterol drugs, Repatha and Praluent, claimed the drugs should cost about one third less than their roughly $14,000 annual price tag. “Even if these drugs were used in just over 25 percent of eligible patients, then employers, insurers and patients would need to spend on average more than $20 billion a year,” Pearson said. Both drugs were found to reduce bad cholesterol by 40 percent or more.

Another ICER report claimed that the $4,600 annual price for Entresto, a new drug to treat congestive heart failure, was 17 percent too high over the short-term. At its current price, Entresto would add $25 billion to the nation’s health care costs over five years. Yet, because the drug provides more health benefits and reduces hospitalization when compared to other treatments, it was cost effective over the long term. But Pearson didn’t seem too concerned with the long-term. “Just because it’s a good long-term value doesn’t mean you could afford it today without jacking up health care premiums a whole lot or doing other things to make money available,” he told a reporter.

While ICER has not explicitly taken policy positions on drug pricing, a recent commentary by Pearson hints at what types of policy he’d like to see:

“The United States is the only industrialised nation without an organised national health technology assessment programme to guide coverage decisions or pricing for new drugs. In part this is because the federal government is prohibited from negotiating the price it pays for drugs in its insurance programmes for the elderly and the poor. It is also a reflection of a political culture that has long been hostile to considerations of cost-effectiveness in funding and insurance coverage decisions.” [Italics added.]

Most other industrialized nations impose price controls on pharmaceuticals and, in some cases, have bureaucracies that decide if a drug is worth the cost before it can be covered by a government health care program. While such policies would be of benefit to insurers in the U.S., as we shall see later, they often have severe consequences not only for the pharmaceutical industry but for patients as well.

Push from the Left

The Campaign for Sustainable Drug Pricing is the Left’s biggest effort to expand government control of pharmaceutical prices. Established in 2014, it is a project of the National Coalition on Health Care, one of the oldest coalitions working on “comprehensive health system reform.”

The hepatitis C drug Sovaldi has been one of the Campaign for Sustainable Drug Pricing’s most frequent targets. Indeed, Solvadi appeared to be the impetus that led to the creation of the Campaign. John Rother, president of the National Coalition on Health Care and head of the Campaign, said in a press release announcing the launch of the Campaign, “Sovaldi is the canary in the coal-mine, alerting all of us that disaster is coming unless something is done to prevent it. Unfortunately, the problem is far bigger than one drug—we are talking about a tsunami of expensive medicines that could literally bankrupt the health care system.”

The leaders of the Campaign are too cagey to state exactly what government action they want. Rather, they release slick statements such as, “We believe there needs to be a better approach to pricing that recognizes value and balances the interests of innovator drug companies with the interests of society and our health care system. Through this Campaign, we hope to capture the attention of the leaders of the biopharmaceutical industry and invite them to engage with us in a dialogue about how best the health care system can sustainably pay for the innovation that is so vital to our well-being.”

While it may not be possible to know exactly what the Campaign’s endgame is in terms of policy, one can make an educated guess. Although its parent organization is often dubbed “bipartisan,” the National Coalition on Health Care is actually a case study in how bipartisan is often a euphemism for liberal. President Rother, for example, was previously the executive officer of policy and strategy for the AARP, where he fought market-based reforms to Social Security and Medicare. Prior to Rother, the NCHC was headed by Ralph Neas, who at one time headed the fierce left-wing pressure group People for the American Way.

The list of groups that support the National Coalition on Health Care reads like a Who’s Who of liberal causes: AARP, AFL-CIO, Children’s Defense Fund, Common Cause, International Brotherhood of Electrical Workers, International Brotherhood of Teamsters, National Council of La Raza, NAACP, National Council of Churches, Small Business Majority, US PIRG (Public Interest Research Group), and United Food & Commercial Workers International Union. Perhaps NCHC gets away with being called bipartisan because its supporters include groups representing physicians and nurses such as the American Academy of Family Physicians, the American Academy of Nursing, and the American College of Surgeons? Or perhaps because it includes insurance companies and trade associations like Blue Shield of California, Alliance of Community Health Plans, and AHIP? It is certainly not because any Republican, conservative, or libertarian groups are supporters.

Then there are the NCHC’s past policy positions. NCHC was a big supporter of Obamacare, the largest expansion of the federal government into the health care sector in history. While CSDP may not explicitly state what policies it supports in response to rising drug prices, one need not be a sleuth to figure out that a NCHC campaign will ultimately back a government expansion into pharmaceutical pricing.

One group that is explicit about policy preferences is the left-wing Center for American Progress. In a recent report entitled “Enough is Enough: The Time Has Come to Address Sky-High Drug Prices,” the Center states, “too often, patients and insurers pay exorbitant prices for their medications, even for products that are no more effective than cheaper options…. Spending on prescription drugs is now growing at a faster rate than spending on any other health care item or service.” The policy changes the report calls for include government interventions such as requiring drug companies “to pay a refund to the National Institutes of Health” if they “do not invest a minimum amount of money in” research and design.

A second government intervention the Center for American Progress recommends is, in effect, a price control. This intervention would incentivize “drug companies to charge reasonable prices.” And “if negotiated prices fall outside the recommended range,” the law should require “public justifications” for the prices and also “license patents that result from federally funded research to competitors.” (Italics added.) Of course, a “recommended” price range really isn’t a recommendation if a drug company that fails to adhere to it has its patents given to competitors. “Price control” is the proper term for a policy that requires drug companies to offer a price in a specific range or face severe, government-imposed consequences. Not surprisingly, some of the Center’s corporate donors include AHIP, Blue Cross Blue Shield Association, and Blue Shield of California.

Is It Really A Crisis?

While the insurance industry and the Left have largely blamed the 13.1 percent growth in pharmaceutical spending in 2014 on specialty drugs like Sovaldi, is it hepatitis C drugs that are solely responsible for the big increase?

No, there are other factors. In 2014, fewer drugs came off patents than in previous years. When a drug comes off a patent, it faces competition from cheaper generics. In 2013, the patent expirations reduced drug spending by just under $20 billion. But that fell to only $12 billion in 2014.

The expansion of the insured under Obamacare appears to have had an impact too. A study by Express Scripts found that early enrollees in the Obamacare exchanges were using more expensive drugs (including some specialty drugs) when compared to persons who had employer-based insurance. Ultimately, that led to about an added $1 billion in new drug costs.

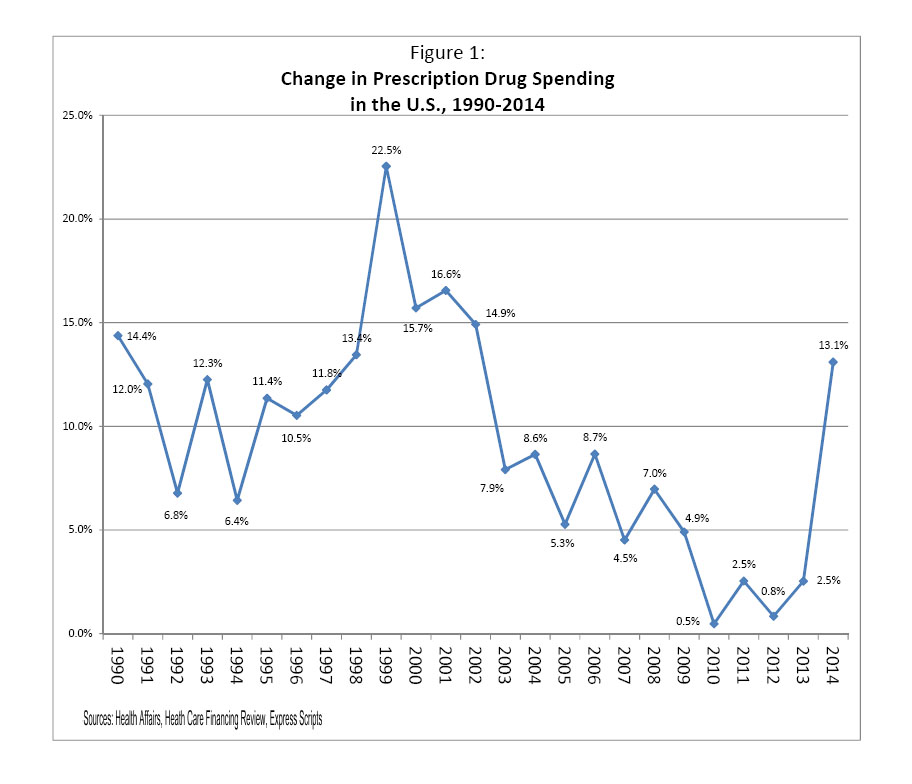

The Center for American Progress claims that this “growing crisis is not sustainable.” But is it really a crisis? The year 2014 was the first time prescription drug spending rose by double digits since 2002. Indeed, as Figure 1 shows, prescription drug spending may be cyclical. In the early 1990s, spending growth fluctuated between single-digit and double-digit increases.

The pharmaceutical revolution of the 1990s brought many new and more expensive drugs to market, resulting in eight consecutive years of double-digit increases in prices (1995-2002). Those large increases in pharmaceutical spending are, in part, what led to the push for Congress to include a prescription drug program in Medicare. But early in the last decade the increases began to taper off, and in the four years prior to 2014 there were barely any increases at all.

Finally, there’s another reason to be wary of hysteria over supposedly skyrocketing drug prices: A study by IMS Institute for Healthcare Informatics, not paid for by industry or government, has tracked year-over-year drug prices and found that list price increases often greatly overstate actual prices paid after off-invoice discounts, rebates, coupons, and other price concessions to payers are taken into account. For instance, “branded pharmaceuticals raised invoice prices on average 13.5% in 2014, but on a net basis, after all of the concessions are adjusted for, the increase was 5.5%. This level of net price increases is notable for being the lowest of the past five years and has occurred even as invoice price increases have accelerated.”

So, are we entering a new era of drug discovery that will lead to large increases in drug spending, or is 2014 a fluke? At this point, we have no way of knowing. What we do know is that calling it a crisis is premature.

The Consequences of Price Controls and Other Government Intervention

Price controls usually result in shortages. Once a producer can no longer cover its costs at the mandated price, it stops providing its product or service.

In a research-heavy industry like pharmaceuticals, price controls will mean less investment. Once investors see that price controls lead to lower profits for drug companies, they will put their money in more profitable industries. Lack of investment will mean less money spent on research, which will result in fewer new drugs coming to the market. Fewer new drugs mean that patients will be deprived of cures or improved treatments for their illnesses.

A comparison of the United States to Europe and Japan, where drug price controls are in effect, demonstrates this truth. In 2013, drug companies based in Europe spent about $33 billion on research and development, while U.S. companies spent $51.6 billion.

A paper by professor Arthur Daemmrich of the University of Kansas Medical Center compared new drug approvals in the U.S., the United Kingdom, Germany, France, Switzerland, and Japan. From 1981 to 1990, U.S. companies produced 32 percent of new drugs. From 1991 to 2000, that increased to 42 percent. Most other nations saw a decline. France dropped from 8 percent to 6 percent, Germany from 15 to 13 percent, and Japan from 29 to 9 percent. The only other country to see a significant increase was the U.K., which went from 6 to 16 percent. Yet the increase in the U.K. occurred despite its price controls. According to Daemmrich, “England’s relative position improved through mergers that produced GlaxoWellcome, SmithKline Beecham, and AstraZeneca.”

Daemmrich also noted that in “the eleven years between 1997 and 2007, firms in the United States [had] nearly forty percent of all FDA approvals and invented slightly over thirty-five percent of all drugs approved by [the European Medicines Agency].” Finally, “[e]ven with a larger population, Europe’s share of global pharmaceutical consumption was nearly fifteen percent less than that of the United States.” While many factors likely contributed to these outcomes, these are exactly the results one would expect when one country, generally, does not have price controls on pharmaceuticals and other countries do.

The one area in which the U.S. does have price controls on drugs is childhood vaccines. It provides a cautionary tale.

In 1993, President Clinton criticized a “shocking” increase in the price of childhood vaccines, claiming that companies were “pursuing profits at the expense of our children.” In response, the administration created the Vaccines for Children (VFC) program, purportedly to help low-income children receive vaccines. The VFC purchased vaccines directly from the manufacturers and then distributed them to physicians and clinics as needed.

The legislation authorizing VFC put price controls on three vaccines, including the tetanus booster vaccine. The controlled price was so low that in 1998, no company bid on the VFC contract for the tetanus vaccine.

On other vaccines that didn’t face strict price controls, the VCF would offer a price that often represented a 25 to 65 percent reduction from its average wholesale price. As a result, by 2001 eight of the 11 childhood vaccines—including ones for diphtheria, pertussis, measles, mumps and rubella—faced shortages. Furthermore, the number of companies providing vaccines dropped to just four. In 1967 there were 26. In short, price controls put the health of children at great risk, surely the exact opposite of the intentions behind VCF.

Britain demonstrates the disaster that can result when a bureaucracy is put in charge of deciding whether a drug is cost-effective. Under Britain’s National Health Service, an agency known as the National Institute for Health and Clinical Excellence (NICE) determines whether new treatments are cost-effective. If it does not approve a treatment, then the National Health Service will not pay for it.

One pharmaceutical that NICE has rejected more than once is Avastin, a drug that can prolong the life of those with advanced cancer. But for patients with late-stage colon or ovarian cancer, NICE did not deem the extra few months of life patients could gain from taking Avastin as worth the cost. NICE has also rejected drugs used to treat lupus, liver cancer, breast cancer, leukemia, and late-stage kidney cancer. A 2010 report by the Rare Cancers Forum found that about 20,000 people could have benefitted from cancer drugs that they could not receive because the drugs were either denied by NICE or were delayed in the decision-making process. It is not known how many of them died prematurely.

One of the more sadly ironic instances of NICE policies on drugs involved Alice Mahon, a former Member of Parliament and ardent supporter of the National Health Service. She suffered from macular degeneration in her left eye, a disease that causes blindness. The drug Lucentis can treat the disease, but it must be taken soon after diagnosis. Mahon was unable to get the drug because NICE had yet to approve it at the time of her diagnosis in 2006. She initially filed a lawsuit, but dropped it after she lost the sight in her left eye and physicians informed her Lucentis could no longer help. NICE did not approve Lucentis until 2013. How many Britons went blind in the meantime is not known.

Conclusion

While drugs like Sovaldi have very big price tags, the costs may very well reflect their value. Hepatitis C can be a debilitating disease, one that can cause liver failure and liver cancer. A liver transplant can easily run more than $500,000, not including the costs of follow-up treatment and immunosuppressive drugs. Spending $84,000 on Sovalid today may well result in a great deal of savings later on.

But the discovery of such breakthrough drugs will be jeopardized if the health insurance industry and the Left succeed in imposing price controls. If pharmaceutical companies cannot charge prices that enable them both to cover their research and marketing costs and generate a profit that is attractive to investors, then the production of new drugs will suffer. Who knows what new cures will never materialize—perhaps ones for AIDS, cancer, or multiple sclerosis—because of price controls.

In a cynical bid to improve its bottom line, the insurance industry is hoping to use government to hamstring the pharmaceutical industry. We will all be worse off if they succeed.

David Hogberg was previously a senior fellow for health care policy at the National Center for Public Policy Research and a senior research associate at the Capital Research Center. He earned a Ph.D. in political science from the University of Iowa and is the author of Medicare’s Victims: How the U.S. Government’s Largest Health Care Program Harms Patients and Impairs Physicians, available at Amazon.com.

(This article was updated after it was initially posted.)