Labor Watch

As Pension Liabilities Soar Unions Ask for More

Governments continue to understate massive unfunded liabilities on public employee pensions

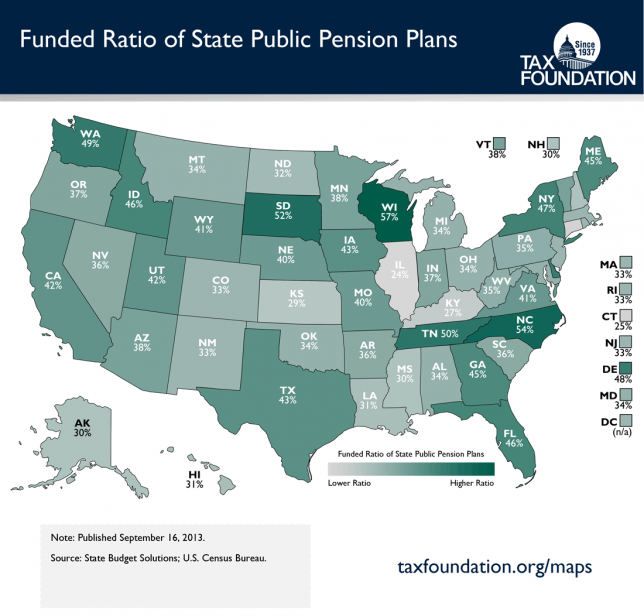

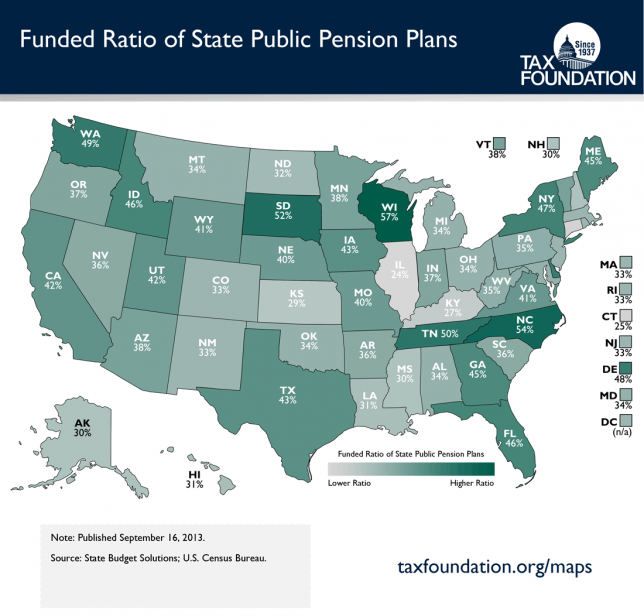

Image via Tax Foundation, goo.gl/Rq3HHM

Image via Tax Foundation, goo.gl/Rq3HHM

A new report by the Hoover Institution entitled “Hidden Debt, Hidden Deficits” finds that the majority of governments in the United States massively underreport the unfunded liabilities in their employee pension systems.

Nearly all governments in the report disclose balanced pension budgets achieved with annual investment return assumptions of 7 to 8 percent. Unfortunately, their real investment returns have averaged 2.87 percent, falling $167 billion short of contribution level needed to keep the systems afloat. Cumulative pension liabilities owed by state and local governments in fiscal year 2015 was a staggering $3.846 trillion.

The Hoover report arrives at this figure by calculating the total “market value” of these liabilities—interest owed plus costs for servicing pension plans—which few government disclosures do. This has the result of hiding the substantial cost of employee pension plans from the general public—at least until payments to retirees are due.

The California state government, for example, identifies unfunded liabilities totaling $242,746,943. But according to Hoover’s calculations, the real figure owed by the Golden State is $769,407,011—or nearly 217 percent more than is officially reported. That’s a conservative figure, too; a Stanford University study estimates a nearly $1 trillion overall funding gap in California, or $76,884 per household.

Illinois, the state with the second-highest pension obligation, reports $188,066,253 in unfunded liabilities; the real figure is closer to $360,521,175. That’s 95 percent higher than is officially reported. While Illinois currently contributes 11.1 percent of its annual budget to servicing pension obligations, Hoover estimates the state must raise spending to 23.4 percent of its budget simply to prevent a rise in overall pension liabilities.

Whether states recognize it or not, America’s pension liabilities are rising at an alarming rate – climbing by $434 billion in 2016-2017 alone. But of the $3.85 trillion in employee pension liabilities held nationwide, only $1.38 trillion is reported by state and local governments.

Much of the country’s looming pension payment crisis stems from sweetheart deals brokered by public sector unions and politicians. Unlike private sector unions, whose fortunes rise and fall with market prices and corporate revenues, public sector unions do not engage in adversarial collective bargaining – a fact AFL-CIO founding president George Meany was keenly aware of when he said that it “is impossible to bargain collectively with the government.” Since governments do not rely on revenues from the market, and are not beholden to a board of directors, public sector unions find little opposition when they demand pay increases for their members.

CRC’s Michael Watson sums it up neatly:

Government worker unions in California have been so successful in winning generous pension benefits that one study found the average pension for a full-career government worker exceeded the average private-sector annual pay in the state.

Higher salaries translates to larger union dues payments, granting unions greater ability to influence elections and public policy. Politicians such as longtime Illinois House Speaker Michael Madigan (D-Chicago) receive millions in contributions from public sector unions, giving them little reason to clamp down on pension spending.

It’s a positive-feedback loop that has racked up trillions in pension liabilities – all paid for by American taxpayers.