A Conversation With The Brothers Author Karl Zinsmeister (Part 1 of 2)

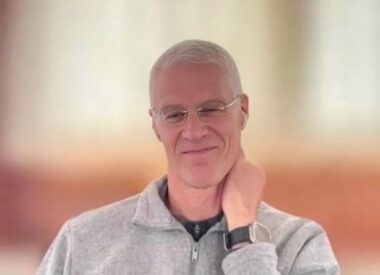

Karl Zinsmeister‘s length and variation of professional experience, along with his depth and breadth of knowledge, give rise to a wisdom from which more should benefit. Luckily, he shares it…