Some Suggestions for Improving the Form 990

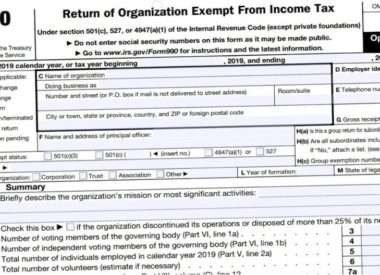

Each year, tax-exempt, nonprofit organizations and foundations are required to file returns with the Internal Revenue Service (IRS). Most of these groups file Form 990, while § 501(c)(3) private foundations…