Labor Watch

The Great Green Pension Hold-Up: Jeopardizing Retirement

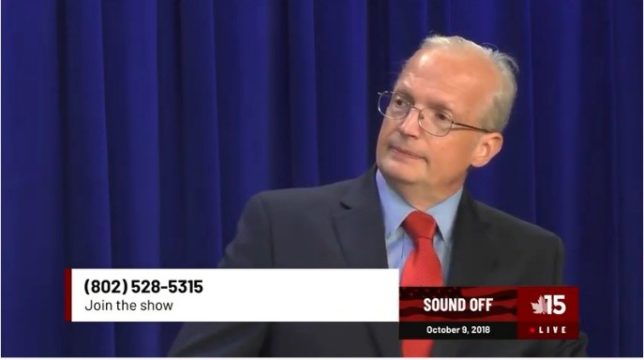

Guy Page was a consultant for Divestment Facts, the national educational campaign about the impact of fossil-fuel divestment. At present, he is the editor/publisher of the Chronicle of the Vermont State House newspaper and online news sites Vermont State House Headliners and Vermont Water Cooler. Credit: Northwest Access TV. License: https://bit.ly/30LkBMB.

Guy Page was a consultant for Divestment Facts, the national educational campaign about the impact of fossil-fuel divestment. At present, he is the editor/publisher of the Chronicle of the Vermont State House newspaper and online news sites Vermont State House Headliners and Vermont Water Cooler. Credit: Northwest Access TV. License: https://bit.ly/30LkBMB.

The Great Green Pension Hold-Up (full series)

Public Pensions as a Political Tool | Jeopardizing Retirement | Labor and Eco-Radicals

Summary: American environmentalists have long promoted political cooperation with labor organizations. There’s at least one issue, however, where cooperation between the two sides proves problematic—and that concerns green demands for public sector pension plans to divest from fossil fuels. Those environmentalist campaigns leave some union members with an uneasy feeling about the future of their pensions—while also making taxpayers nervous.

The Vermont Example

The state of Vermont is home to Middlebury College, which has a long association with 350.org founder Bill McKibben. It was at Middlebury that McKibben took some of his early steps as a green activist. So no one should be surprised that Vermont became, from 2013 to 2017, one of the first states to face a prolonged fossil fuel divestment campaign targeting its public employee retirement system.

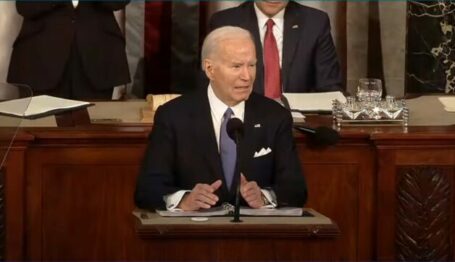

The campaign began, recalled Guy Page, a longtime journalist and public affairs consultant based in Berlin, Vermont, with “climate change activists making an argument to the Vermont legislature that the state could lead the nation by signaling its commitment to the transition from fossil fuels to renewable power—and mandate that the state pensions divest from fossil fuel holdings. The activists presented this as a simple, easy thing to do, that everyone who is concerned about climate change should do.” 350.org was heavily involved with that campaign.

During the divestment push, Page was a consultant for Divestment Facts, the national educational campaign about the impact of fossil-fuel divestment mentioned earlier. At present, he is the editor/publisher of the Chronicle of the Vermont State House newspaper and online news sites Vermont State House Headliners (https://www.pagecommunicationsvt.com/) and Vermont Water Cooler (https://www.vtwatercooler.com/).

Page went on to say:

A large minority of climate change-minded legislators agreed with the idea, but they did not have enough votes to pass divestment legislation. The retirees who depend on Vermont’s public pensions—which hold about $4 billion in assets—expressed their strong concerns about how this move might hurt the pension system’s investment returns. Vermont’s pension system has a multi-million-dollar deficit, which represents a huge issue for the state budget. In terms of demographics, Vermont is already the third-oldest state after Maine and New Hampshire.

The solvency of those pension plans therefore assumes additional political importance for Vermont’s population.

Undaunted, 350.org and its allies such as the Vermont chapter of the Sierra Club pressed on, holding events, issuing press releases, and bringing public pressure on State Treasurer Beth Pearce, who oversees the Vermont public pensions, to support divestment.

In response, the argument that Page and others made could by summarized as: “Divestment will hurt the Vermont public pensions’ investment returns, while also likely increases the costs of running the pensions. Given the relatively small size of the Vermont pensions, divestment of their fossil fuel holdings will do very little to reduce carbon emissions—while possibly hurting retirees, their families, the state budget and state economy.”

With the opposition expressed by retiree groups weighing heavily in the minds of lawmakers, the divestment push in the legislature stalled. In his 2016 State of the State address, Peter Shumlin, then-Governor (and political ally of Bill McKibben) upped the ante by calling for Vermont to join hands with California and other states by legislating divestment of its public pensions from coal and oil holdings.

And then, Page said, “a very remarkable thing happened. Governor Shumlin began publicly questioning why the State Treasurer, Beth Pearce—who Shumlin had appointed to office, by the way, in 2011—wouldn’t get on board with divestment.” Pearce and Shumlin are both Democrats.

Later in 2016, a special committee was formed to study the effects of divestment on Vermont’s public pensions. Pearce also commissioned an independent report by a pension consulting firm on divestment and possible impacts on both retirees and the state. That study, released in February 2017, found that divestment would not be “in the best interests of [Vermont] pension beneficiaries, and conflicts with [Vermont public pensions’] governance structure.”

That study, after it was made public, put the final nail in this particular divestment campaign’s coffin. Vermont would not throw its pensioners under the bus, or sacrifice the state economy, Page said, for the dubious distinction of “leading the nation and setting an example” on climate change.

Page shared one further observation about the divestment campaigners:

If carbon emissions need to be reduced, why don’t the activists talk more about how emissions-free nuclear power can assist in that? Or planting more trees? From my perspective, peeling back their rhetoric, I think many of these campaigners are using reducing carbon emissions as a kind of camouflage. The real problem in their minds isn’t in fact carbon, but rather consumption. Their utopia is an America of people living in small houses, in highly centralized, urbanized areas, with very little access to cars and so on. If controlling consumption is your objective, then limits on carbon emissions represent a very powerful tool to achieve your goal.

Attempted Divestment in the Empire State

With more than $210 billion in assets, the New York State Common Retirement Fund is the third largest U.S. public pension, investing on behalf of the more than one million individuals belonging to the New York State and Local Retirement Systems (NYSLRS). In terms of governance, the elected New York State Comptroller serves both as sole trustee for the Fund, and as administrative leader of NYSLRS.

The incumbent Comptroller, Thomas DiNapoli, has for about two years now been on the receiving end of a noisy public lobbying campaign by 350.org and its co-thinkers, such as Fossil Free New York. The goal: to push DiNapoli to use his influence over the Common Retirement Fund to divest its holdings from fossil fuels. This has included e-petitions, a steady drip of news releases, protesting crowds—as well as mocking statements by 350.org’s founder Bill McKibben, who once observed the Comptroller “is threatening to become inertia’s avatar” for “clinging to the old normal” and not embracing the divestment agenda. McKibben has also compared DiNapoli’s efforts to engage with the oil industry to the hero of the Charlie Brown comic strip, who was perpetually falling prey to another character’s offer to hold a football for him to kick, only to pull it away at the last moment.

The pressure on DiNapoli to go along with this campaign has only been increased by the fact that New York state’s Governor, Andrew Cuomo (D), and the Mayor of New York, Bill De Blasio (D), are both proud political allies of Big Green, and eager supporters of divesting public pensions of fossil fuel-related holdings.

DiNapoli, so far, has dared to defy the calls for divestment. Citing New York State’s Constitution, he and his Fund colleagues have repeatedly asserted that their primary legal obligation is to be “focused on generating returns to provide for benefits owed to the members of the retirement system”—and not tailoring the Fund’s investment approach to please this or that activist group. (A very similar argument helped defeat a divestment push led by 350.org in 2017, focused on the Seattle City Employees Retirement System; despite bringing political pressure, including from Seattle’s Mayor, to give into 350.org’s demands, the system’s board held firm to its primary responsibility to put the needs of system members and retirees first.)

Indeed, in April, the Fund pointed out how divestment would imperil its ongoing efforts to keep investment costs low for plan members (and taxpayers). “The vast majority of the Fund’s public equity holdings are invested passively—that is, by replicating index funds,” a Common Fund representative said in testifying to the state legislature. Divesting from specific energy-related holdings would mean transferring “hundreds of millions of dollars from the [Fund’s] beneficiaries into Wall Street’s hands by forcing the Fund to customize everything it does and straying away from low cost passive strategies. There will also be trading costs in millions of dollars incurred as a result of both selling these companies and also buying stock to replace them.”

An irony of 350.org’s campaign is that, divestment aside, DiNapoli has been very “green” in other aspects of his oversight. Under his leadership, for example, the Common Retirement Fund has used its proxy voting rights to push for greenhouse gas emission reductions, analysis of climate risks and so on at nearly 70 of the companies in which the Fund owns shares. DiNapoli has defended his “shareholder engagement” approach as good for the environment while also consistent with his duty to Fund beneficiaries, but this isn’t good enough for 350.org.

In late April 2019, the New York state legislature was set to begin hearings on a bill requiring the Fund to divest from fossil fuels over the next five years. A month prior to the hearings, to help build momentum for the legislation, supporters held a public gathering at the Legislative Office Building in Albany. In addition to the elected officials who spoke in favor of the bill, Bill McKibben of 350.org and Lisa DiCaprio from the Sierra Club also spoke.

“Around the world institutions of all kinds are realizing that the time has come to break with the ruinous industries of the past…The Empire State has always provided the world’s financial leadership, and we hope this will be no exception,” McKibben said via video link from his home in Vermont.

Timed with the start of the hearings in April, one labor organization decided it was an opportune moment to inject some hard facts into a discussion where heated rhetoric often takes center stage.

The Suffolk County Association of Municipal Employees (AME), based on Long Island, commissioned a study entitled The Cost of Divestment. Authored by Foster & Foster, an independent national actuarial consulting firm, the study provided a sobering look at the potential costs to New York City and New York State public pension plans by shifting fund assets from fossil fuels holdings into “green energy” investments.

One scenario examined in the study forecast shortfalls requiring “up to $33.4 billion in additional contributions to the state fund and up to $18.9 billion in extra contributions for the city’s pension system. That would mean slashing pension benefits or massive cuts to vital government services or large tax hikes to make up for the shortfalls,” the association noted in an April 29th press release.

The study provided another perspective on the divestment debate. It represented a bottom-line reminder that, when a public sector plan has lower than expected returns from its investments, any persistent shortfall will have to be made up, at someone’s expense. One way is either through contribution increases or benefit reductions that fall on the plan members. On the taxpayer side, an underfunded public pension obligation at the city or state level can translate into both higher taxes and fewer services, as funds are re-directed to cover the deficit.

Needless to say, the study was funded by Suffolk AME’s own resources, and not through donations via the various Rockefeller philanthropies or the Tides Foundation.

“I represent about 6,000 active municipal employees and 4,000 retirees, and I felt we had to find out the impact of divestment on their public pensions by commissioning a formal, objective study,” explained Dan Levler, Suffolk AME President. “After we saw the data about the impact of divestment, we shared it with other unions and decided to make the information public.”

In taking a public stance, Levler said, “we always knew that, if the data was referenced in media articles, for example, [the pro-divestment side] would make some implication against me.” And they did. In a statement to the New York Daily News that appeared in an April 30th article, a 350.org organizer named Richard Brooks dismissed the Suffolk study as follows:

It’s a last-ditch effort by folks who are speaking on behalf of the fossil fuel industry. This isn’t just about the politics or the ethics, it’s about the financial risks and doing what’s right for the pensioners and moving away from a risky industry.

Commented Levler: “I wish they hadn’t so quickly gone for the low blow like that, claiming that I work for someone else—when, in fact, I’m focused on working for the diverse working people who make up Suffolk Country AME’s membership.”

The Suffolk AME study helped catalyze a coalition of New York municipal labor groups as well as uniformed public sector employees. The study became a useful educational tool that helped both leadership and membership to better understand the stakes of the divestment debate. It was complemented by additional tactics, including an online petition, a dedicated website that portrayed the danger divestment poses to pensions as an attack on working families’ economic well-being, and so on.

“This debate about divestment is not just about the fate of polar bears—it’s about the fiduciary responsibility of the public sector pensions to earn their required return on investments. The more restrictive an approach you take to what the funds can invest in,” Levler observed, with tongue in cheek, “and the more attached you become to what I call the investment ‘fads of the day,’ well—you might just restrict yourself to investing in apples!”

“But pensions cannot be turned into policy experiments—and when you rank symbolic statements over performance, it isn’t in anyone’s best interest,” Levler said.

Suffolk AME’s “just-the-facts” approach, and rapid action both on-line and off-line, seems to have carried the day. Despite all the bluster of the state Senate hearing, the divestment legislation died in committee. That doesn’t mean 350.org and its political allies won’t try again.

A final observation about 350.org’s personal attacks on Dan Leveler and Tom DiNapoli: In 2015, the National Association of Scholars (NAS) published a 300-page examination of the divestment movement, tracing its development and emergence as a force on many college campuses. The report was entitled: “Inside Divestment: The Illiberal Movement to Turn a Generation Against Fossil Fuels.”

Inside Divestment’s introduction makes this searing assessment: the divestment crusaders represent “an assault on the heritage of American political theory,” in part because of how they “sidestep real debates about energy and environmental policy and scorn discourse as needless delay” but also because “[t]he campaign smears opponents and bullies dissenters.” The report goes on: “[A]nyone who disagrees with divestors [is] a mercenary of the fossil fuel industry…”

Four years after NAS released its study, not much has changed.

In the conclusion of The Great Green Pension Hold-Up, learn how the movement tried to capture California.