Featured Items

Tax Reform without the SALT

Update: According to the plan unveiled by Senate Republicans, if passed, it would repeal the State and Local Tax Deduction (SALT).

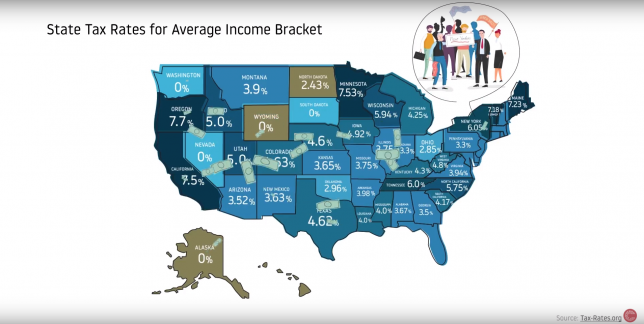

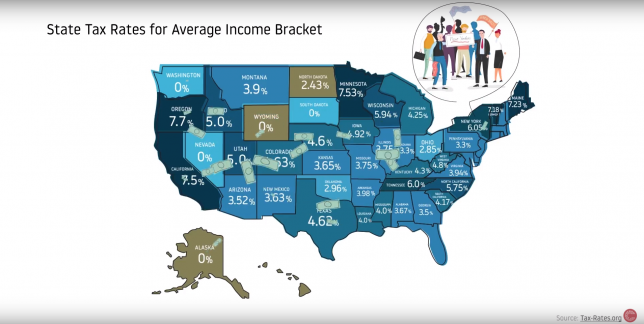

With Tax Reform in the news, you’ll be hearing a lot about “flattening the tax code.” But getting rid of the deductions that benefit special interests won’t be easy – particularly in wealthy states with powerful ties to lawmakers in Washington, D.C.

One of the most important is SALT — the State and Local Tax Deduction. SALT was designed to prevent federal tax collectors from squeezing money from Americans that would otherwise go to local governments. In effect, however, SALT has made it easier for high-tax states (such as California and New York) to collect income tax subsidies from the federal government, paid for by states which have smaller, more efficient governments.

SALT only saves around 2 percent of the income of middle class Americans; while wealthy individuals can expect to save around 7 percent each year thanks to the law. Getting rid of the SALT deduction seems like common sense, but politics makes it difficult.

Watch our short video on SALT here: