Labor Watch

Union Pensions in Crisis

The Hidden Danger to Workers, Employers, and U.S. Taxpayers

(Labor Watch, November 2009 PDF here)

Unions pensions are in trouble, and financial watchdogs such as Moody’s Investor Services are starting to sound the alarm. Not only are many union retirement plans critically underfunded, but some are so badly underfunded that even current retirees could end up getting pennies on the dollars they were promised. Unions are reluctant to admit their problems and are resisting genuine reforms to fix the problem or soften the blow. Why? Former Labor Department official F. Vincent Vernuccio went looking for answers. Are you counting on a union pension?

If so, be very afraid. So says a recent report, “Comparing Union Sponsored and Private Pension Plans: How Safe are Workers’ Retirements?” by Diana Furchtgott-Roth, Senior Fellow and Director of the Hudson Institute’s Center for Employment Policy, and Andrew Brown, an independent economist. Furchtgott-Roth and Brown report that many union pension plans do not have enough money to pay for the retirements they promised to provide their workers, and the problem is only getting worse.

Furchtgott-Roth told Labor Watch that union pension underfunding is a “massive problem.” Brett McMahon, vice president of Miller & Long Construction Co., and a major voice in the union pension debate, heartily concurs. How big a problem? Mc- Mahon says, “If you use the TARP money as a figure, it is in that neck of the woods.” TARP money—the funds Congress authorized to try to head off a financial meltdown— is $700 billion. The coming crisis in union pensions, he argues, could easily be just as costly.

When Furchtgott-Roth first released her analysis of union pension underfunding in summer 2008, she was the target of vicious union attacks. The SEIU called her report a right wing ”hatchet job” and lambasted an article she wrote in the New York Sun. The union claimed her numbers were all wrong, saying “as of January 1, 2008, SEIU’s national pension fund for rank and file members was 96 percent funded. In 2006, it was funded at 92 percent. The accurate funding level is calculated by using the funding measure required by the Pension Protection Act of 2006.”

That’s a big difference from Furchtgott- Roth’s findings. She argued that her numbers were more sound because she took all her data from the Department of Labor’s Form 5500 which the pensions themselves file. The Wall Street Journal, using the same data, reported “SEIU National Industry Pension Plan – which covers some 101,000 workers – was only 75 percent funded in 2006. … and some 13 local SEIU pension plans in 2006 were less than 80 percent funded, several didn’t reach 65 percent.”

The unions vehemently disagreed, but Furchtgott-Roth was vindicated on April 30 of this year when the SEIU was forced to tell its members that its National Industry Pension Fund was in “critical” status. It was funded at less than 65 percent, which means that the union will probably not be able to pay out as much in pension benefits as it promised its future retirees. In fact, the union could even have trouble meeting its obligations to current retirees. Previously, the SEIU came up with rosy calculations about pension coverage derived from a formula used under the state’s Pension Protection Act of 2006. Ironically this act requires the union to inform members about funding problems with their pensions.

This September Furchtgott-Roth and Brown updated the 2008 study. They also considered current legislation before Congress that may affect pensions, such as the Employee Free Choice Act (EFCA), which will allow union organizers to replace secret ballot elections with signed cards to signify that workers want union representation. Furchtgott-Roth told Labor Watch the numbers got worse in the past year. Because the new data does not take into account the impact of the financial crisis, which occurred in late 2008, it seems probable that the current state of union pensions is far worse.

How could the SEIU claim that its numbers are better than the findings in Furchtgott- Roth’s first report in 2008 and its subsequent admission that its pension is in “critical” status? She states simply, “It is because they are lying.” The issue is one that nobody at the union wants to touch. SEIU refused several requests to comment on Furchtgott- Roth’s latest study or even the general issue of pension underfunding.

Navigating the Retirement Maze

Let’s back up a moment and define the available types of employee retirement plans. “Defined contribution” plans consist of 401(k) plans, 403(b) plans, employee stock ownership plans, and profit-sharing plans. The assets in the plan are held in the name of the recipient. They are typically funded by employee and/ or employer contributions, and participants generally have a good deal of control over how and where funds are invested. The participants are entitled to the entire sum of the plan when it vests after a prescribed period of time. Defined contribution plans are portable and allow an employee changing jobs to move the entire vested retirement sum to his next employer. The amount in a defined contribution plan can fluctuate in relation to the success of its investments.

Critics of defined contribution plans argue they are too risky and undependable. Boosters argue that defined contribution plans allow workers to have career mobility without worrying about losing their retirement savings. They also argue that defined contribution plans that are thoughtfully invested tend to yield higher returns than traditional pensions over the lifetime of the participant.

The principal alternative to a defined contribution plan is a “defined benefit” plan. It is typical of the traditional pension offered by an employer who pays a specific amount to an employee in retirement after he reaches a specific age and has worked for the employer for a specified number of years. The length of time required for vesting in a defined benefit plan is usually greater than for a defined contribution plan, and to receive full benefits employees usually must have worked for their entire career with the same employer or union. The amount of the pension is “guaranteed” by the employer or union and annual benefits are fixed and not subject to market fluctuation. The plan is managed by a fiduciary, and participants have little or no say in how their money is invested.

Critics claim defined benefit plans yield less of a return then defined contribution plans. They also claim defined benefit plans are not as safe as the unions maintain because the plan can go bankrupt and any pension insurance will be far less than what was originally promised. Proponents respond that defined benefit plans are safer because they are “guaranteed,” provided the plan stays solvent, and its assets do not fluctuate like personal investments in defined contribution plans. They also claim defined benefit plans are safer because they are insured by the federal government.

Unfortunately there is more to defined benefit plans than meets the eye and the details are devilish. There are two types of defined benefit plan. Single employer defined benefit plans can be independently set up by a single employer. They also can be created through a collective bargaining agreement with a union. But even if a single employer defined benefit plan is created with a union, the employer generally controls all aspects of the plan.

Multiemployer plans are different. They are defined benefit plans which arise out of a collective bargaining agreement between more than one employer and one or more unions. They were created by the Taft-Hartley Act of 1947 and are sometimes know as Taft- Hartley plans. Multiemployer plans allow unionized workers to keep their pension when they switch jobs within unionized industries covered by the multiemployer agreements.

Unionized industries such as construction, entertainment, food, hotels, and transportation frequently have multiemployer defined benefit pension plans. The plans cover about 20 percent of workers in defined benefit plans, i.e., about 10 million active and retired workers in the United States. Unlike a defined contribution plan where a worker can take his 401(k) with him wherever he goes, a multiemployer plan allows a worker to change jobs but requires him to stay in the same union or plan for his entire career to receive full benefits.

Defined benefit plans are insured up to a set amount by the federal government-chartered Pension Benefit Guarantee Corporation, an agency set up by Congress in 1974 under ERISA (the Employee Retirement Income Security Act). If a defined benefit plan cannot meet its obligation the PBGC will step in and provide pensions for participants in the plan. The current maximum amount insured by the PGBC for a single employer plan is $54,000 per year for workers who retired at the age of 65. The insurance problem is more acute for multiemployer plans. Here the benefits are far less: a worker with 30 years of service can only receive a maximum amount of $12,870 annually. That can be a huge blow to workers who were guaranteed $60,000 or $80,000 annually.

Unions vs. Pension Protection

The Pension Protection Act is an important pension reform that was signed into law by President George W. Bush in 2006 but subsequently amended and weakened in 2008. One of its more important provisions is its effort to define when a direct benefit pension plans is healthy and when it is in danger. The act places pension funds in categories depending on their funding levels. A pension plan that has less than 80 percent of the assets it needs to cover all current and projected liabilities is considered to be in “endangered” status. A plan with less than 65 percent is considered to be in “critical” status.

The contributions to the plan are established by collective bargaining negotiations between a union and many companies. Multiemployer plans still have the same PPA reporting requirements as single employer plans. Like single employer plans, multiemployer plans must also inform their participants if their plans fall in “endangered” or “critical” status. Plans in “endangered” status must devise a rehabilitation plan to return to normal funding levels which is defined as funded 80 percent or more within the next 10 years. Plans in “critical” status must devise a 10 year plan but they are required to immediately cut certain vested benefits.

Furchtgott-Roth says the Pension Protection Act will definitely help the underfunding problem but warns that unions are trying to roll back the act’s funding requirements. In her study she writes “looking at union communications, it is clear that union leadership prioritizes raising benefits over securing them. Nowhere is this clearer than in criticisms of the Pension Protection Act. The Teamsters, for example, criticize full funding requirements as this provides a legal reason for employers to refuse to increase pension benefits.”

She explained, “Unions frequently lambaste their employer opponents for opposing increased benefit plans, usually listing their proposals as ‘reasonable’ or ‘affordable.’. The fact that unions often push for benefit increases in the face of employer protests of unreasonable cost lends weight to the argument that they place more importance on the promised level of benefits than on the actual security of those benefits.”

In 2008 PPA requirements were weakened when Congress passed the Worker, Retiree, and Employer Recovery Act of 2008. WRERA adds an extra three years to the 10 year rehabilitation plan. Those who monitor the health of defined benefit pensions are troubled by WRERA because it allows plans to choose to “freeze the plan status” during the current financial crisis. In other words, when pension plans have to certify their safety status, they are allowed to substitute the amount of their fiscal year 2008 funding levels in place of the actual amount of their assets for the “plan year” beginning October 1, 2008 and ending September 30, 2009.

This is pure sleight of hand. Even if a plan’s funding fell in 2009, it would not have to report its “endangered” or “critical” status to its members because the plans were deemed healthy in 2008. McMahon says that this “overrides one of the key points of the Pension Protection Act… It allows pension plans to choose to ignore the current losses and say this isn’t really happening… It really is a terrible thing to do to pensioners and how this is allowable under fiduciary duty is beyond me.”

Workers’ Pensions in Peril

A “fully-funded” pension plan must have assets to cover all of its current and projected liabilities. Consequently, when the ratio of assets to liabilities is equal to or greater-than-one, the plan is fully funded. The study by Furchtgott-Roth and Brown warns that when the ratio is less-than-one a pension fund may be in danger because it is by definition “underfunded.” The authors suggest that it is possible that “an ‘underfunded’ plan reflects mismanagement of funds, either inadvertent or corrupt.”

Their study revealed that only 17 percent of union pension plans were fully funded in 2006 compared to 35 percent of non union plans. Only 59 percent of unions had funding levels above PPA’s “endangered” status compared to 86 percent of non union plans. Finally, 13 percent of union plans were in “critical” status but only 1 percent of non-union plans were in the same category.

In real numbers the study reported that “in 2006, collectively-bargained defined benefit plans held approximately $890 billion in assets. Multiemployer defined benefit plans, most of them collectively-bargained, had approximately $340 billion.” For Furchtgott-Roth and Brown this has to be a slow moving train wreck. “In light of the vast, acknowledged deficiencies in union pension funding,” they write “these assets should be much higher.”

How widespread is the problem? “At last count,” and, remember, the last count was before the current financial crisis hit, “157 collectively-bargained defined benefit plans had reported being in ‘critical’ status … Another 146 were in ‘endangered’ status.” The authors also noticed a further disparity: “Among 438 union pension plans in critical condition, only 24, or 5 percent, contributed enough to meet annual costs. Of the 54 non-union plans in critical condition, 21, or 39 percent, were in the same situation.”

Last September Moody’s Investor Services seconded Furchtgott-Roth in warning about the perilous funding condition of multiemployer defined benefit plans. Its report, Growing Multiemployer Pension Funding Shortfall is an Increasing Credit Concern looked at the Labor Department’s Form 5500 for 126 multiemployer plans in 2007. With 2008 information yet unavailable, the data represented the best look at the majority of assets and obligations for all multiemployer plan. Moody’s remarked, “despite the limitations in the data a very stark picture emerges.” The 2007 data showed the plans overall were only 77 percent funded and had a total underfunding of $87 billion. By contrast, comparable single employer defined benefit plans were funded at 101 percent.

But what about the condition of defined benefit pension plans after the financial meltdown at the end of 2008? Moody’s estimated that funding levels for the single employer plans it examined had fallen and now were only at 75 percent. As for multiemployer plans, Moody’s warned that “when data for year end 2008 is finally released, it will probably show substantial deterioration in asset values during 2008.” It estimated that the multiemployer plans surveyed from 2007 would be only 56 percent funded. In other words, they would be underfunded by about $165 billion dollars.

A Union Pension Is Fine—If You Work for the Union

Perhaps one of the reasons for the fury over Furchgott-Roth’s original findings was an interesting disparity that she uncovered. She showed that union staff pension plans were better funded than their rank and file counterparts, and union officer pension plans were even better than that.

The study analyzed 30 union staff and officer pension plans of some of the largest 46 rank-and-file pension plans in the country. The average funding level for rank-and-file plans was 79 percent in 2006 percent. (Nine of the plans were fully funded, however 24 were less than 80 percent funded, and 11 of the 24 were in “critical” condition.) Union officer plans were even better off. They had an average of 93 percent funding and only eight of the 30 were less than 80 percent funded and only two were in critical condition. Furchtgott-Roth believes union staff and officers have better funded pensions because they have more control over them and the benefit amounts are prescribed in their contracts. The study clearly shows that union officer pension plans have funding levels closer to single employer plans as opposed to their multiemployer rank-and-file counterparts.

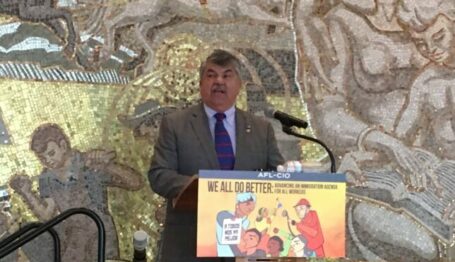

Unions are strong advocates of defined benefit plans. They argue that the cost burden of pensions should be on the employer and risk should not be shifted to the individual employee. The AFL-CIO claims “union workers have a union advantage in pensions” and that “employer-provided pensions are an essential part of retirement security.” With this us-against-them mentality, the AFL-CIO accuses employers of trying to shift “investment risk and responsibility to individual workers” by putting them into defined contribution plans to “reduce corporate costs.”

When labor unions argue that union members are more likely to have a pension plan than non-union members they tend not to mention the funding status of these plans. McMahon has an alternate explanation for why unions favor the crumbling status quo. He believes that unions want to stick with defined benefit plans because “that is what keeps people in.” McMahon points out that if a union member who contributed to a union multiemployer pension plan came to work for his non-union construction company that worker would lose the promise of substantial retirement benefits.

For instance, he says a middle aged worker would not only need to consider his earnings but would have to “weigh the opportunity against losing what he thinks could be a $60,000 to $80,000 retirement, and he is rightfully hesitant given the information he has. That is why this is so insidious.” Mc- Mahon believes workers are not informed if their defined benefit pension plan is likely to be underfunded and whether it could fail. Workers also aren’t told about the limitations put on a multiemployer plan that is bailed out by the PBGC, which limits what a worker receives to a maximum of $12,870 annually. “That’s cat food money,” he says.

Miller & Long’s McMahon argues if the worker knew his pension was worth $12,870 instead of $60,000 to $80,000 “it could be a whole new ball game for the worker to consider leaving the union.” Unfortunately, most workers don’t know the level of underfunding of many multiemployer plans. They don’t appreciate the likelihood that these plans could be taken over by the federal government. Instead, they join unions because they mistakenly think unions guarantee their pensions. And that’s why labor unions resist all efforts to tell their members that their pension funding levels are in deep trouble.

Furchtgott-Roth says the problem has only gotten worse since her first study and that union members “have no idea what is going on.” Her research showed how “incredibly difficult the information on pension plans is to find.” Because the information is so dated, it’s hard to clearly warn workers of dangers ahead. Congress made the problem worse when it passed the WRERA. She is outraged that unions are “misleading workers as to the state of their pension benefits and luring workers from perfectly good benefit plans into plans that are not worth the paper they are written on.”

Don’t Be the “Last Man Standing”

The “last man standing” rule is the most worrisome aspect of union multiemployer plans to a businessman like McMahon. Under this plan each employer shares the risk of funding the pension with every other employer. Employers are liable not only for their own employees but also for the employees of every other employer in the union plan.

The multiemployer pension concept is based on the recognition that individuals in transient industries like construction or hotels are apt to work for many companies over their careers. Unions know it is unfeasible to expect one company to provide pension and retirement benefits to employees who work for them for short or sporadic periods of time. That’s what made multiemployer plans attractive. By pooling the risk among multiple companies in the same industry there was less danger to the unionized employee should any one company close down or go bankrupt. The other companies would make up the shortfall without a “shock” to the system.

But what if the plan is underfunded? Then the remaining companies need to make more contributions to provide for so-called “orphans,” employees of companies no longer in the system. The liability for orphans and for failing companies puts a heavy and potentially disastrous burden on both existing companies in a multiemployer pension plan and on newly unionized companies that join the plan.

Last year, UPS paid $6.1 billion in withdrawal fees just to escape further crushing obligations of the Teamsters Central States pension fund, which turned out to be a good call. Earlier this year the Teamsters’ plan was required to send out a letter to current and future pensioners alerting them that the plan was in critical status.

In May, William Zollars, CEO of the trucking company YRC Worldwide applied for $1 billion in relief from government TARP funds. He noted the crushing burden of pension obligations on his company’s bottom line. The company owes about $2 billion to various multiemployer plans. About half that, or $1 billion, will go to finance the retirements of workers who never worked a day for any of YRC’s companies.

McMahon warns if his company were unionized and forced into one of these plans “we would have to close because we would have to be responsible [for more beneficiaries] than we could ever contemplate. It would be a nightmare.”

What to Expect Next

Current proposed legislation such as the Employee Free Choice Act may help temporarily alleviate the underfunding problem—but at a huge cost. EFCA, as originally proposed, had two main sections. The first was what is known as card check, which would effectively eliminate the secret ballot in union elections. This would make organizing much easier and allow unions to bring in more members. The second was mandatory binding interest arbitration, where a government official can create the terms of the first contract between a union and a company if an agreement is not reached after 120 days of negotiation and if one side requests arbitration.

Furchtgott-Roth and McMahon argue that unions are desperate to pass EFCA in order to bring in millions more new members. This will help temporarily address the problem of multiemployer pension underfunding. Furchtgott-Roth calls the process “a giant Ponzi scheme.” To keep paying out pensions, you need more contributors. McMahon likens the problem to Social Security, “but unlike Social Security we do not have the luxury of kicking the can down the road.” He says, “EFCA is precisely designed to shore up these pensions plans.”

“Organized labor is fully aware of how deeply troubled their pensions plans are and how unsustainable they have become. The only ways for [the plans] to recover is a government bailout, which is something the union are working on actively, or else bring in a bunch of young people to contribute to the plan and extend the period of time before they are eligible to receive the benefits back,” McMahon warned Labor Watch.

F. Vincent Vernuccio, an attorney, is a former Special Assistant to the Assistant Secretary for Administration and Management at the Department of Labor under President George W. Bush. He is editor of efcaupdate.org and a frequent contributor to Labor Watch.

Note: Furchtgott-Roth notes that researchers face many problems obtaining and using Form 5500 data in a format which can be easily processed. Pension participants and members of the public must either travel to the Department of Labor (DOL) building in Washington D.C. to look up and print individual plan information or they must file a Freedom of Information Act request. As of the date of this publication, DOL has Form 5500s information in an electronic searchable database called the ERISA Public Disclosure System (EPDS). This information is in an electronic format and networked. However, DOL has not provided Form 5500 data to the public on the internet where it would be easily accessible.

LW