Labor Watch

Union Pension Funds Go Green But It’s Not the Color of Money

(Labor Watch, September 2008 PDF here)

Organized labor officials are using their control over union pension funds to promote their own political agenda at the expense of rank-and-file union members. By promoting shareholder resolutions that advance environmentalist causes, among other “progressive” goals —as part of the unions’ “corporate campaign” strategy—unions are building a stronger political coalition, but they may be violating their fiduciary responsibility to their own members and putting workers’ retirement security at risk.

The American Left has long been a coalition of disparate special interests. Feminists, environmentalists, and labor unions appear to have little in common, but they have learned how to come together to support each other’s agendas. What unites them is their need for government power to tax and spend and regulate private sector activities. This coalition’s delicate balance can be upset when the groups’ agendas conflict. For example, in 2001 the Teamsters strongly endorsed President Bush’s plan to explore for oil in the Arctic National Wildlife Refuge (ANWR), which nearly all environmental activists oppose.

However, unions and green activists are now setting aside their differences to pursue a broader left-wing agenda. The Teamsters union recently reversed its position on ANWR. Unions and environmentalists have discovered a more important location than the Arctic in which to build their coalition: Wall Street. To win green support, unions are proposing to leverage their member pension funds to push for policies favored by the environmental establishment— to the detriment of rank-and-file union pension holders.

A Blue-Green Alliance is Born

It is increasingly common for major labor unions to work closely with environmental activist groups. Notably, the Service Employees International Union (SEIU) and UNITE-HERE, the textile and hospitality union, have joined with environmental activist groups to pressure corporate America to adopt policies to reduce their “carbon footprint”—the amount of their emissions of carbon dioxide and other greenhouse gases.

Unions, in coalition with green groups, employ a variety of tactics against corporations: They launch advertising campaigns, file lawsuits, appeal for government regulation, and introduce shareholder resolutions at company annual meetings. All of these are components of what are known as “corporate campaigns”— onslaughts designed hold a company’s reputation hostage to its compliance with union demands.

The pairing of unions and environmentalists is familiar to observers of corporate campaigns. Labor unions, hoping to avoid being identified as the prime movers behind a corporate campaign, rely heavily on their allies to attack a targeted company’s record. Nonprofit advocacy groups that claim to be acting in the “public interest” mask the union’s obvious self-interest. By claiming to be fighting “sweatshop” labor or environmental pollution, environmental and “human rights” activist groups (such as the Interfaith Committee for Worker Justice) serve as proxies for the union, thus obscuring the union’s self-interested motive to gain economic concessions from the company. Environmental activist groups have become steadfast union allies, creating a “blue-green alliance” of blue collar workers and middle class environmentalists.

But here’s what’s new. Increasingly, it appears that unions are leveraging their pension funds to push companies to adopt policies favored by green activists— even when they don’t benefit the unions’ own members. Those policies add nothing to—and may even detract from— the shareholder value of pension funds which unions are supposed to be managing for their members’ benefit. Rank-and-file union members need to take this situation seriously—and ask questions of their pension fund administrators.

Defining Responsibility Down

In planning a corporate campaign, unions and activist groups typically research their target and identify its weaknesses. A key pressure point is a company’s need for capital. That has allowed unions to use their pension funds to buy shares in companies, which allows them to introduce shareholder resolutions at corporate annual meetings. More and ing Environmental Defense Fund, Sierra Club, National Wildlife Federation and World Wildlife Fund—as well as the AFLCIO and UNITE-HERE (a union that left the AFL-CIO in 2005 and joined the new Change to Win union federation).

INCR couches its rhetoric in the language of financial prudence: “As fiduciaries and long-term investors, we see significant long-term risks from climate more companies are facing aggressive union-sponsored shareholder resolutions. For years, such resolutions were intended to advance some union interest—but recently they have been put forth to advance the agendas of environmental advocacy groups.

Consider the Investor Network on Climate Risk (INCR). This is an alliance of unions, state pension funds, financial services firms and foundations that seek to force the issue of global warming onto companies’ agendas. The signers of INCR’s 2008 Action Plan include Service Employees International Union president Andrew Stern, UNITE-HERE president Bruce Raynor, California Public Employees’ Retirement System (CalPERS) board president Rob Feckner and California State Teachers’ Retirement System (CalSTRS) CEO Jack Ehnes. INCR, in its 2008 Action Statement, claims $1.75 trillion in assets under management, with another $6.5 trillion under management of “supporters in principle.”

INCR is a project of Ceres (pronounced “series”), an organization that describes itself as “a national network of investors, environmental organizations and other public interest groups working with companies and investors to address sustainability challenges such as global climate change.” Ceres members include the major environmental groups—includchange to the value and security of our investments and capital markets more broadly,” states its 2008 Action Plan. [Emphasis added.] Yet managers at the companies in question do not seem all that concerned about climate change as a serious risk. So do these activist institutional investors know something that company managers do not? Not at all. Caveats like the “more broadly” mentioned above allow for considerable wriggle room in the definition of fiduciary responsibility.

Pension fund managers typically understand their fiduciary duty to consist in working to the best of their ability to increase the value of the assets they are entrusted to manage. But organized labor, allied with outfits like INCR, aggressively has sought to redefine fiduciary duty to allow this politicization of pension funds. As Diana Furchtgott-Roth of the Hudson Institute notes in a recent study:

Over the years, unions have successfully changed the operative meaning of fiduciary duty. This process of change started in the early 1990s when the AFL-CIO published Proxy Voting Guidelines. These guidelines encouraged union pension funds to consider not only how investment decisions would affect a pension fund’s financial performance but also the effect of these decisions on communities, the environment, and the economy. This overly broad interpretation of “fiduciary duty” has allowed unions to join forces with others in the left-leaning progressive community by making investment decisions whose goals are not always consistent with traditional investment strictures.

At a 2005 Federalist Society forum, AFLCIO Associate General Counsel Damon Silvers said that union fund managers must ask the question, “Are these assets being managed in our interest?” But the unions’ answer redefines the concept of the union’s “interest” far beyond questions that are typically dealt with in labor management relations. Silvers noted that the AFL-CIO’s view of good corporate governance is “different” from that of a hedge fund manager, since the labor federation sees companies as “collaborative” arrangements, more than “a bundle of contracts.” For unions, labor-management “collaboration” in the unions’ interest can encompass issues that do not necessarily add shareholder value—for instance, increasing union membership in a company workforce. Ultimately, unions’ expanded definition of fiduciary responsibility has less to do with improving investment performance than with making political gains.

Panelists at the Federalist Society forum debated the significance of a series of adversarial shareholder resolutions offered in 2004 to the management of Safeway, the grocery store chain. Silvers of the AFL-CIO argued that “Safeway had a series of governance problems” to explain why public employee pension fund managers in ten states, including the giant CalPERS, offered the resolutions.

But at the time the United Food and Commercial Workers union was on strike against Safeway over health care benefits, which led other forum panelists to question the resolutions’ timing. According to The Wall Street Journal, Sean Harrigan, who then headed the CalPERS’s board, used CalPERS’s Safeway investment to pressure the company to accept the union’s demands. Public employee pension funds are among unions’ best allies today—while not directly controlled by unions, union officials are frequently members of their boards of directors.

Go Green—or Else

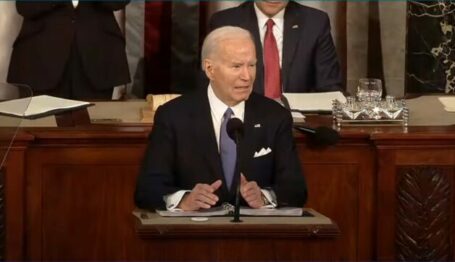

Increasingly, labor unions are using expanded definitions of fiduciary responsibility to force companies to endorse or adopt climate change policies. AFL-CIO president John Sweeney rallied the green troops early this year. On February 12, in a speech at the United Nations Summit on Climate Risk—which was sponsored by Ceres and the United Nations Foundation— Sweeney described how organized labor will make use of union pension funds to promote a brave new green world: We need a new economic strategy…

And I believe a key part of the answer—for the U.S. and other deseeks “to engage companies, investors, and others; and to support policy action” that embeds climate change mitigation into corporate decision-making. The INCR agenda is detailed—and unlikely to increase shareholder value. It wants “companies to elevate climate change as a governance priority,” and seeks “shareholder resolutions, company engagements, and other efforts to encourage companies to reduce their carbon footprint, seize new market opportunities, and ask corporate suppliers to disclose and reduce greenhouse gas emissions and energy use.”

INCR favors government policies that would hurt businesses, large and small, by making energy more expensive. The Action Plan calls “for a mandatory national policy to contain and reduce national greenhouse gas emissions economyveloped countries—lies in meeting the critical worldwide need for a solution to the energy and environmental crisis….

Executing this strategy requires deploying our current human and financial capital to secure a future we want to live in. Much of that capital is workers’ retirement funds. Trillions of dollars around the world are invested to provide retirement security and education to billions of people. In the U.S., $5 trillion is invested on behalf of union members…

Investors can lead, and make money by leading. The labor movement expects those who have been entrusted with our members’ money to do just that. [Emphases added.]

As a member of Ceres’s Investor Network on Climate Risk (INCR), the AFL-CIO is able to work with some powerful allies. According to its 2008 Action Plan, INCR wide,” leading to “60-90 percent reductions below 1990 levels by 2050,” and “for a binding target to reduce emissions significantly in the United States.” Whatever climate-related problems these emissions reductions would address pale in comparison to the economic calamities they would create by drastically limiting access to affordable energy—an essential ingredient of economic development.

This agenda would burden companies with risky and impractical goals and politicize corporate governance. By urging companies to invest in the development of “clean, climate-friendly technologies” to the tune of “$10 billion collectively in additional investment over the next 2 years,” INCR imposes high risks on investors because these technologies are, by definition, untested. It also pushes investors to accept the improbable goal of “a 20 percent reduction over a three-year period in energy used in core real estate investment portfolios.”

Most worrisome of all, INCR wants “to engage the SEC and members of Congress on requiring companies to disclose material climate risks as part of their regular securities filings.” It’s anyone’s guess what such a new regulatory burden would do to help increase shareholder value. However, on July 14, 2008, a U.S. Senate Appropriations Committee report endorsed Ceres’s agenda. It admonished the SEC and told it to pay heed to a petition filed by certain Ceres members:

The Committee is aware that a petition was filed with the [Securities and Exchange] Commission on September 18, 2007, calling for the issuance of an interpretative release clarifying the application of existing law to the disclosure of risks associated with climate change. The Commission is encouraged to give prompt consideration to this petition and to provide guidance on the appropriate disclosure of climate risk.

The Ceres petition was filed by pension fund groups with extraordinary financial clout. They included the California State Employees’ Retirement System (CalPERS), the nation’s largest pension fund with $248.8 billion under management (as of April 30, 2008), and the California State Teachers’ Retirement System (CalSTRS), the nation’s second largest with $162.2 billion under management (as of June 30, 2008).

What’s Behind the Alliance?

Sound investing this is not. Yet organized labor sees one big advantage: It strengthens its alliance with environmental activists, who give labor the leverage it needs in mounting corporate campaigns. Making alliances with nonprofit “public interest” groups is key to Big Labor’s corporate campaign strategy.

When John Sweeney became president of the AFL-CIO in 1995 he announced his commitment to place corporate campaigns at the forefront of labor organizing strategy. Before taking the reins at the AFLCIO, Sweeney headed the stridently activist SEIU, which perfected the strategy. In his AFL-CIO inaugural address he proclaimed, “We will use old-fashioned mass demonstrations, as well as sophisticated corporate campaigns, to make worker rights the civil rights issue of the 1990s.” Shareholder resolutions are an important tool in this effort. In 1995, the AFLCIO established the Center for Working Capital, as part of its effort to leverage union financial assets. Sweeney’s strategy got a further boost during the Clinton administration.

In May 1998, the Securities and Exchange Commission (SEC) revised its Rule 14a-8. This rule allowed shareholders who meet certain floor criteria to submit social policy resolutions and have them included in the company’s proxy materials. Before 1998, companies could exclude proposals that dealt with the environment or human rights. But the SEC rule change allowed resolutions to go before shareholders despite management objections. One of the driving forces behind the change were the 2,000 letters that political activists sent to the SEC, notes George Washington University professor Jarol Manheim in his book, Biz-War and the Out-of-Power Elite: The Progressive-Left Attack on the Corporation (Erlbaum, 2004).

The stage for this change was first set in 1994, when the Department of Labor, under then-Secretary Robert Reich, published a regulatory bulletin—Interpretive Bulletin 94-1—which allowed pension funds to divert money to “Economically Targeted Investments” (ETIs). These are “investments selected for the economic benefits they create apart from their investment return to the employee benefit plan.” In a New York Times op-ed Reich cited one example of a good ETI practice: CalPERS “decid[ing] to make workplace practices a criterion for managing investments.” Rep. Jim Saxton (R.N.J.) responded in a Wall Street Journal op-ed. He noted that “ETIs are really PTIs—Politically Targeted Investments—and use participants’ money in ways that would not occur except for political pressure.” In 1995, Rep. Saxton introduced H.R.1594 to “place restrictions on the promotion by the Department of Labor and other Federal agencies and instrumentalities of ETIs in connection with employee benefit plans.” The bill passed the House, 239-179, but failed in the Senate. (Undoing this policy, which Rep. Saxton failed to do, would be a worthwhile legacy for the Bush Labor Department as it enters its final months.)

Increasingly, unions are flexing their financial muscle in other policy areas. In 2005, the AFL-CIO pressured banks and brokerage firms to steer clear of the Alliance for Worker Retirement Safety, a group of investment firms supporting the Bush Social Security plan to create private accounts. The unions organized protest rallies in New York, Washington, San Francisco, and 70 other cities, according to The New York Times. Under pressure, two firms, Edward Jones and Waddell & Reed, dropped out of the Alliance, while Alliance members Charles Schwab and Wachovia announced they would take no position on the Bush plan.

The Labor Department responded in a May 3, 2005 letter cautioning the AFL-CIO against spending workers’ money in union-run pension funds for such political ends: “The Department reiterates its view that plan fiduciaries may not increase expenses, sacrifice investment returns or reduce the security of plan benefits in order to promote collateral goals.” The department’s main concern was over the AFL-CIO “using pension plan assets to pay for communications to plan participants on options to reform Social Security.” This violated fund managers’ fiduciary responsibility to “act solely in the interest of participants and beneficiaries and for the exclusive purpose of paying benefits and defraying reasonable administrative expenses.”

The AFL-CIO replied that it was taking action because the Administration’s Social Security reforms could impact pension funds. However, the Labor Department rejected labor’s position, arguing: If a fiduciary could characterize an “educational” expense as “plan management” merely by positing some connection between the particular policy at issue and the broad economic interests of ERISA-covered plans, there would be virtually no limit to the range of such expenses that would be permissible. Federal policies concerning public debt, trade, exchange rates, interest rates, housing, the environment, labor, tax law, anti trust law, bankruptcy law, criminal law, civil rights, and myriad other matters have important effects on the economy and economic actors such as ERISA-covered benefit plans.

The Department noted that it is appropriate to communicate the effects of specific policies to plan participants, since these affect their investments’ value directly. But it advised that “Giving plan participants information directly relevant to particular plan choices, however, is very different from expressing views or providing information concerning broad issues of public policy like Social Security reform.” And what about the First Amendment rights of union and non-union members who support the President’s plan? For the 28 states that do not allow workers to reject union representation as a precondition for employment in unionized companies, the AFL-CIO’s position would force some workers to pay for a political position they do not hold.

What About Performance?

When labor unions use their pension funds to push a political agenda they will incur a cost—one borne by rank-and-file union members. In a July 2008 study, the Hudson Institute’s Diana Furchtgott- Roth, former chief economist at the U.S. Department of Labor, found that most union pension plans were funded much below the levels of pension plans provided by employers or groups of employers. She notes that, while pension managers may take out loans and leverage assets in other ways, 80 percent constitutes a threshold of healthy funding. It is dangerous for pension assets to drop below 65 percent of the funds they need.

Union-negotiated pension schemes consistently maintain dangerously low ratios of assets to liabilities. This is especially obvious when they are compared to pensions provided by private companies to non-union workers. Although nearly 90 percent of non-union funds had at least 80 percent of the funds they need, only 60 percent of union plans were at or above that mark.

Compared to pension plans for rank-and-file employees, the pensions funds for union officers and staff were in much better shape. Furchtgott-Roth notes that this undermines the argument that lower pension fund values could be explained by weaknesses in the economy or the stock market. She compares SEIU’s general and staff pension funds:

In 2006, the SEIU National Industry Pension Plan, a plan for the rank-and-file covering 100,787 SEIU workers, was 75 percent funded. A separate fund for the union’s own employees had 1,305 participants and was 91 percent funded. The pension fund for SEIU officers and employees had 6,595 members and did even better, at 103 percent funded….

Comparing the pension funds of members to the pension funds for officers and staff of the SEIU shows strong evidence that neither poor market returns nor the weak economy explain the national pension’s underfunding.

The success of the officers’ funds shows the heads of the national organization know how to properly fund a pension plan if they choose to.

(“Unions vs. Private Pension Plans: How Secure are Union Members’ Retirements?” Hudson Institute, available online at www.hudson.org.)

So what is going on? Furchtgott-Roth places much of the blame on the fact that in recent years, union-controlled pension funds have “become more involved in corporate and political battles that do not seem directly related to investment returns for their beneficiaries.”

There is one other factor to consider. The enactment of the 2002 Sarbanes- Oxley Act, in the wake of the Enron and WorldCom scandals, sparked an unanticipated response. Some companies tried to avoid American regulation by listing and trading their shares in overseas financial centers like London and Hong Kong. But others have sought to avoid burdensome government regulation altogether. Known as private equity firms, they do not publicly list their shares on stock exchanges.

Because they do not trade publicly, private equity firms are not directly exposed to the kinds of union-influenced shareholder pressures that publicly traded companies face.

However, union officials are busy adapting to this new investment environment. Although not publicly traded, private equity firms need large amounts of capital— which a union’s pension fund can supply. Analyzing private equity firms, Wall Street Journal columnist Alan Murray suggests that union control over pension funds “makes the firms more open to union arguments than most public companies.”

(For more, see Ivan Osorio, “Unions Grasp For Influence Over Private Equity, Labor Watch, October 2007.)

Conclusion

That unions should seek to increase their influence is hardly news. But that they should seek to do so at the expense of their rank-and-file members is troubling— especially when while doing so they abandon any pretense of acting to help individual union members. Union members need to ask their pension administrators some serious questions. As environmental causes become the object of ever more shareholder resolutions, and as these are backed by union pension funds, union leaders are putting their members’ retirement security at unnecessary risk.

Ivan Osorio is editorial director at the Competitive Enterprise Institute and former editor of Labor Watch.

LW